Solana ETF to debut in Canada after approval from regulators

- Solana ETF will go live in Canada this week after the Ontario Securities Commission greenlighted applications from Purpose, Evolve, CI and 3iQ.

- The products will allow staking, enabling investors to earn yield on their holdings.

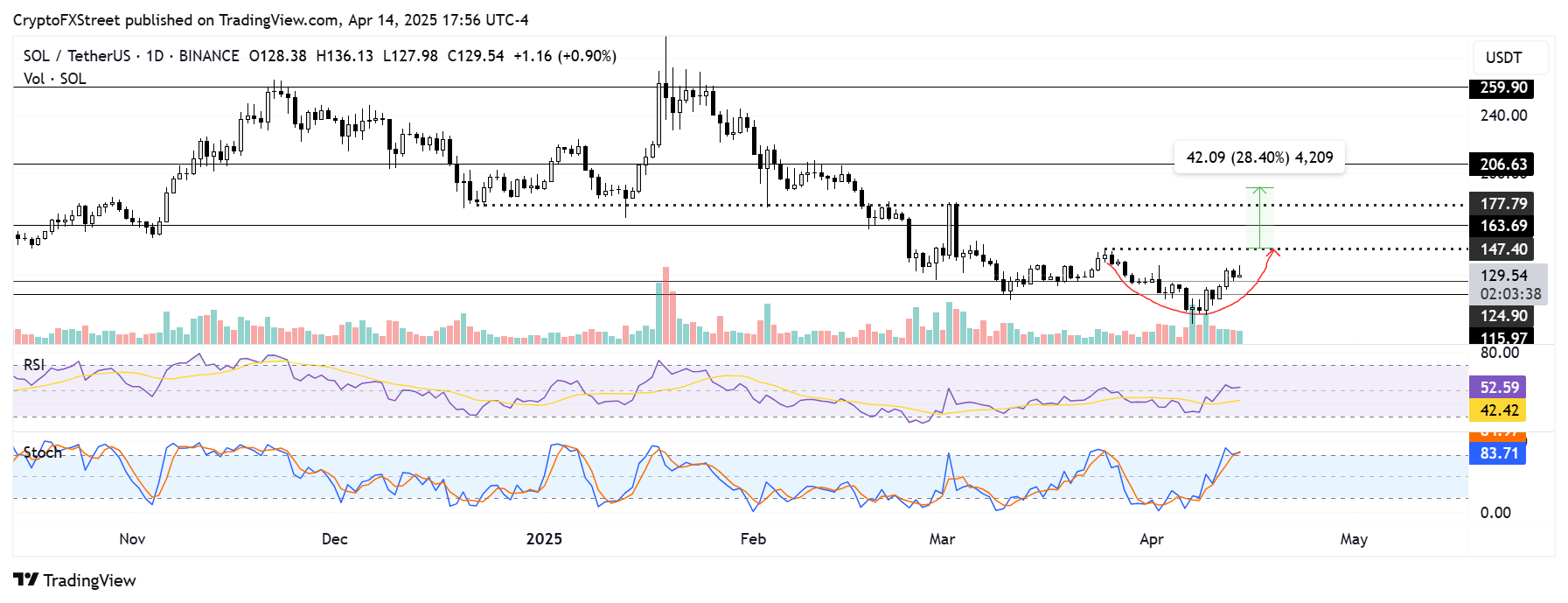

- SOL could complete a rounded bottom pattern if it smashes the resistance near $147.

Solana (SOL) is up 2% on Monday following reports that Canadian regulator OSC approved several asset managers' SOL ETF applications.

SOL ETFs to launch on Wednesday in Canada

The Ontario Securities Commission (OSC) approved the applications of four issuers, including Purpose Investments, Evolve ETFs, CI Global Asset Management and 3iQ, to list and trade ETF products tracking Solana's spot price, according to an X post by Bloomberg analyst Eric Balchunas.

The funds — expected to debut on Wednesday — will directly invest in SOL tokens but track a different SOL price index. Additionally, the products will permit staking of their underlying assets, allowing investors to earn yield on their holdings. This feature could boost appeal and interest in SOL ETFs among institutional investors.

However, Balchunas hinted that the products could underperform, considering two recently launched SOL futures ETFs in the US, Volatility Shares SOL ETF and 2x SOL ETF, have failed to attract notable inflows. According to data from Volatility Shares, the products have a combined asset under management (AUM) below $15 million. In contrast, the Teucrium 2x XRP ETF raked in over $17 million in AUM within one week of launch.

https://x.com/EricBalchunas/status/1911793767431954663

The approval comes as issuers wait for the US Securities and Exchange Commission (SEC) to decide on SOL ETF applications.

SOL could surge above $177 if it completes a rounded bottom move

SOL is up 2% after recovering the support near $125 over the weekend and is aiming to complete a rounded bottom pattern. A rally above $147 that establishes it as a key support level, could see SOL soaring above $177. However, it faces a key hurdle near $163, which was a key resistance from August to October 2024.

On the downside, SOL could find support near $125.

SOL/USDT daily chart

The Relative Strength Index (RSI) is above its neutral level, indicating dominant bullish momentum. Meanwhile, the Stochastic Oscillator is in the overbought region, signaling potential for a short-term correction.