XRP Price Prediction: How Ripple's alignment with the $18.9T tokenization boom could impact XRP

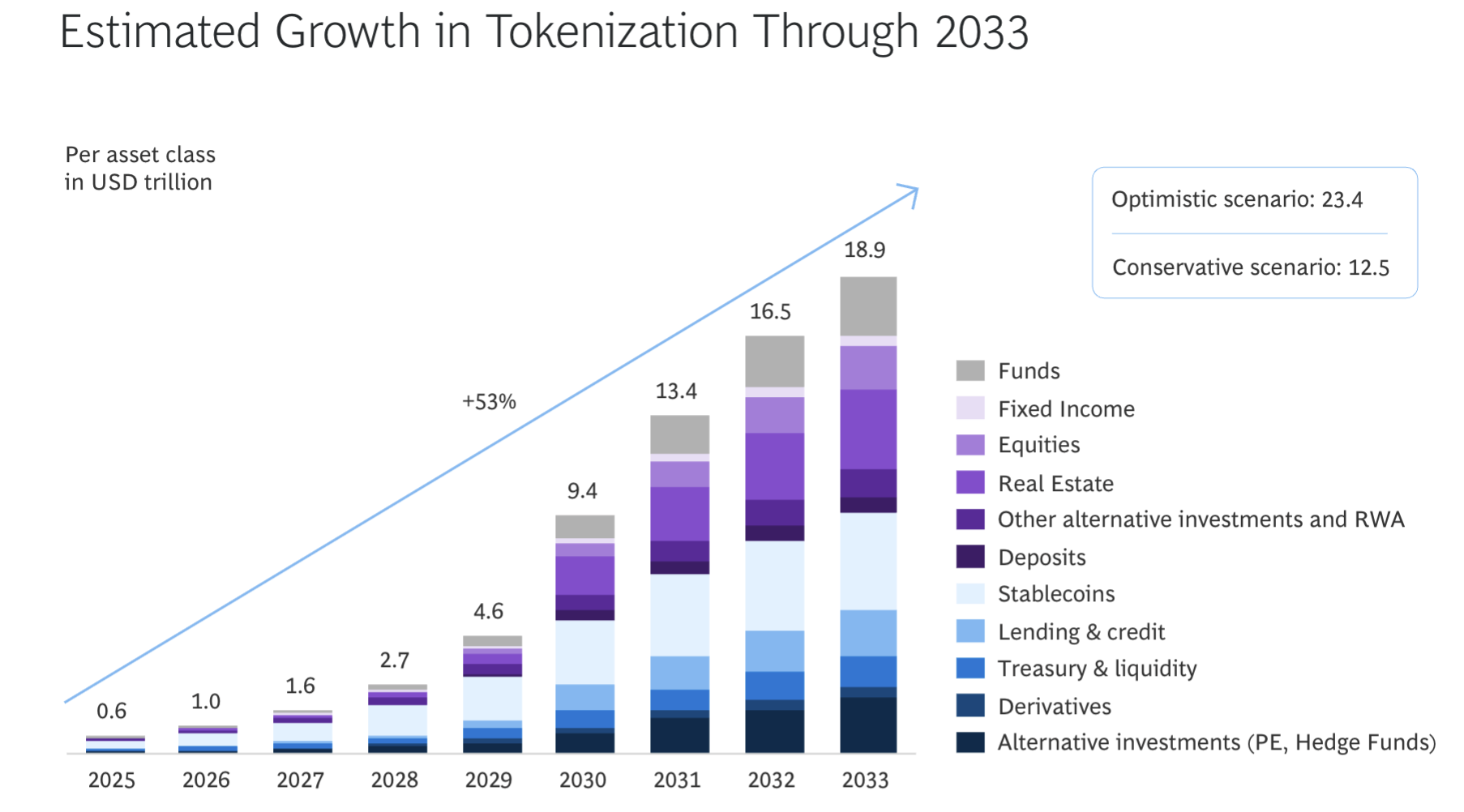

- A Ripple-BCG report projects that global asset tokenization will grow from $0.6 trillion in 2025 to $18.9 trillion by 2033.

- Ripple plans to leverage XRP Ledger for seamless cross-border payments and settlements, fostering XRP adoption.

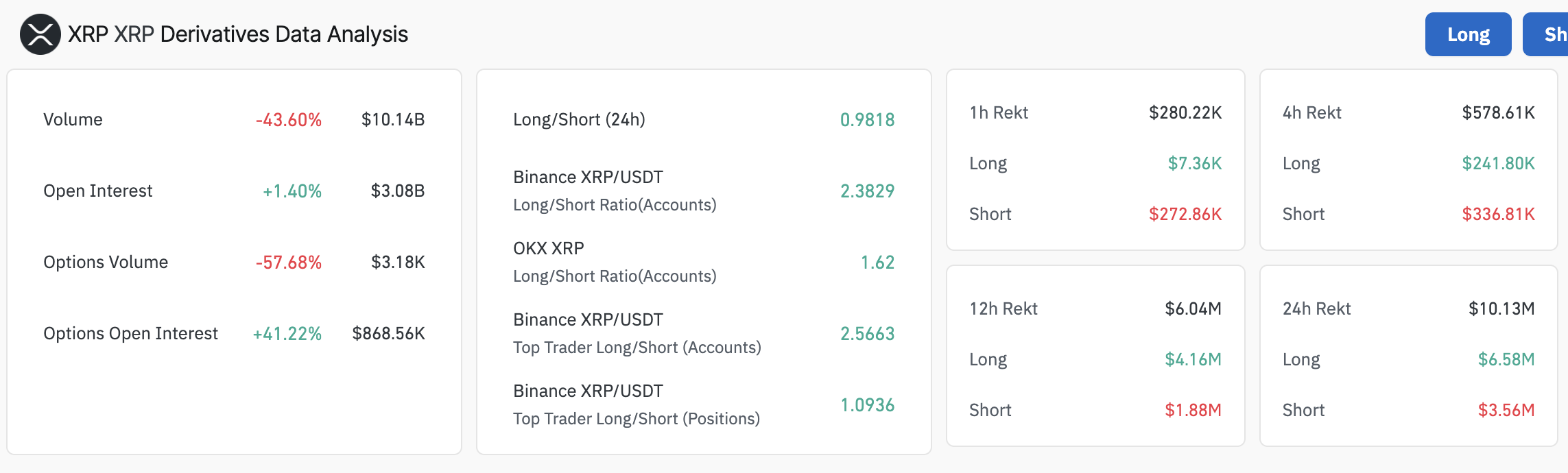

- A 1.4% increase in open interest to $3.08 billion and a positive long/short ratio imply increasing bullish potential.

- XRP reclaims support above the 200-day EMA as bulls target a short-term move to $2.25 on Friday.

Ripple (XRP) approached the critical $2.00 level during the Asian session on Friday after a minor correction the previous day reinforced higher support at $1.95. The tariff pause-triggered recovery tagged $2.09 on Wednesday, but the uptrend faltered as global markets adjusted and digested the dynamics of the tariff policy in the United States (US). A report by Ripple and Boston Consulting Group (BCG) lays out the current state of tokenization, projected growth in five to eight years and why this is the right moment for early movers, including institutions, to pace up and shape the market.

Ripple positions XRP as a bridge asset in the evolving tokenization market

Global finance has, for many decades, operated on a seemingly fragmented and outdated infrastructure that is continuously out of sync with the way markets, clients, and capital operate, according to the report titled "Approaching the Tokenisation Tipping Point."

Tokens have transformed from basic cryptocurrency units into financial and non-financial instruments like securities, property and funds, enabling fractional ownership, instant transfer and settlement, and regulatory compliance.

The report projects that the tokenization of real-world assets will grow from $0.6 trillion in 2025 to a colossal $18.9 trillion by 2033, representing a 53% compound annual growth rate. The US is already at the forefront of the tokenization flywheel, scaling tokenized funds, treasuries and collateral. President Donald Trump’s current administration will likely speed up development by pushing for clear regulations for digital assets.

Estimated tokenization growth through 2033 | Source: Ripple-BCG report

In a historic move on Thursday, the President signed into law a bill that prevents the Internal Revenue Service (IRS) from collecting data used for tax reporting from decentralized crypto platforms.

The Ripple-BCG report highlights that tokenization is beyond a technological novelty but an amalgamation of factors, including technological maturity and regulatory and institutional advancement. This confluence creates a suitable environment for adopting XRP as more institutions turn to the digital asset economy, seeking blockchain solutions that foster longevity and regulatory engagement.

"The shift to a tokenized economy is turning financial assets from static instruments into dynamic software. Tokenization isn't a digital overlay or an addition to the global financial system—it's a redesign of the infrastructure layer that financial institutions have depended on for years," Ripple and BCG said in the report.

XRP price stabilizes ahead of weekend liftoff

XRP hovered around $2.00 at the time of writing on Friday, with the 200-day Exponential Moving Average (EMA) providing immediate support at $1.95. This structure suggests that bulls have the upper hand.

Although the Relative Strength Index (RSI) sits below a descending trendline, it has recovered from near oversold conditions to 43.62, increasing bullish momentum.

A daily close above the key $2.00 level would affirm XRP's strengthening technical structure, thus encouraging more traders to seek exposure. A breakout to $2.25, marking a confluence between the 50-day EMA and the 100-day, will likely follow.

XRP/USD daily chart

Liquidation data shows an interesting symmetry between long and short positions in the 4-hour timeframe. Long liquidations are significantly lower at $241,800 compared to short liquidations at $336,810, suggesting bears are more vulnerable to the upward trend in XRP price. At the same time, a 1.4% increase in the derivatives' open interest to $3.08 billion hints at increasing capital inflow and improving sentiment.

XRP derivatives analysis data | Source: Coinglass

XRP holds below a descending trendline resistance from the yearly local top at $3.39, the 50-day EMA and the 100-day EMA, signaling continued bearish pressure that must be overcome for a sustainable uptrend.

Moreover, the token is not immune to macroeconomic pressure, especially with the US and China escalating the tariff war. President Trump announced a 90-day tariff pause on Wednesday. Still, experts warn that there could be far-reaching implications as countries negotiate favorable terms, potentially impacting XRP price performance.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.