XRP price could surge to record highs backed by strong on-chain metrics, derivatives and US crypto bills

- XRP is closing in on the $3.00 hurdle as interest in the derivatives market ticks higher.

- US House Representative French Hill says that there are enough votes to pass the crypto bills, including the stablecoins' GENIUS Act.

- The surge in the New Addresses metric signals rising adoption and demand for XRP.

Ripple (XRP) is edging higher again, up over 2% to trade at around $2.99 on Wednesday. The drop from highs slightly above $3.00 reached on Monday saw XRP find support at $2.80. With the uptrend back on course and closing in on the short-term hurdle at $3.00, focus is quickly shifting to the all-time highs of $3.40, tagged in January.

Market overview: Passage of US crypto bills could boost XRP rally

United States (US) President Donald Trump stepped in on Wednesday, seeking to revive the momentum for cryptocurrency legislation following a 196–222 vote against advancing the bill in the House of Representatives on Tuesday.

President Trump stated that 11 out of the 12 House Representatives he met with had agreed to support the GENIUS Act bill, which paves the way for the establishment of regulations for stablecoins.

House lawmakers are expected to discuss the CLARITY bill and the Anti-Central Bank Digital Currency (CBDC) Surveillance State Act during the ongoing 'Crypto Week.'

The passage of these bills could put the US at the forefront of innovation in the cryptocurrency industry by establishing a clear framework that protects investor interests while advancing adoption. US President Trump believes these key legislations could bolster the country to become the crypto capital of the world.

House Representative French Hill told CNBC on Wednesday that there are enough votes in the House to pass all three crypto bills, including the US Senate's GENIUS Act, which was passed in June.

"I believe the House has the votes for those three measures and the speaker is working this morning on how they will be coordinated and presented to the House for consideration," Hill said.

Crypto-based companies like Ripple could benefit immensely from the passage of the GENIUS Act and the CLARITY Act, considering the company issues two tokens, XRP and the RLUSD stablecoin.

Ripple has been working to expand its stablecoin and Ripple Payments infrastructure in the US, European and Asian regions. RLUSD is a regulated stablecoin designed for institutions, serving as a bridge between the digital asset economy and the traditional financial system. Ripple Payments is a platform primarily used for cross-border value transfer utilizing XRP.

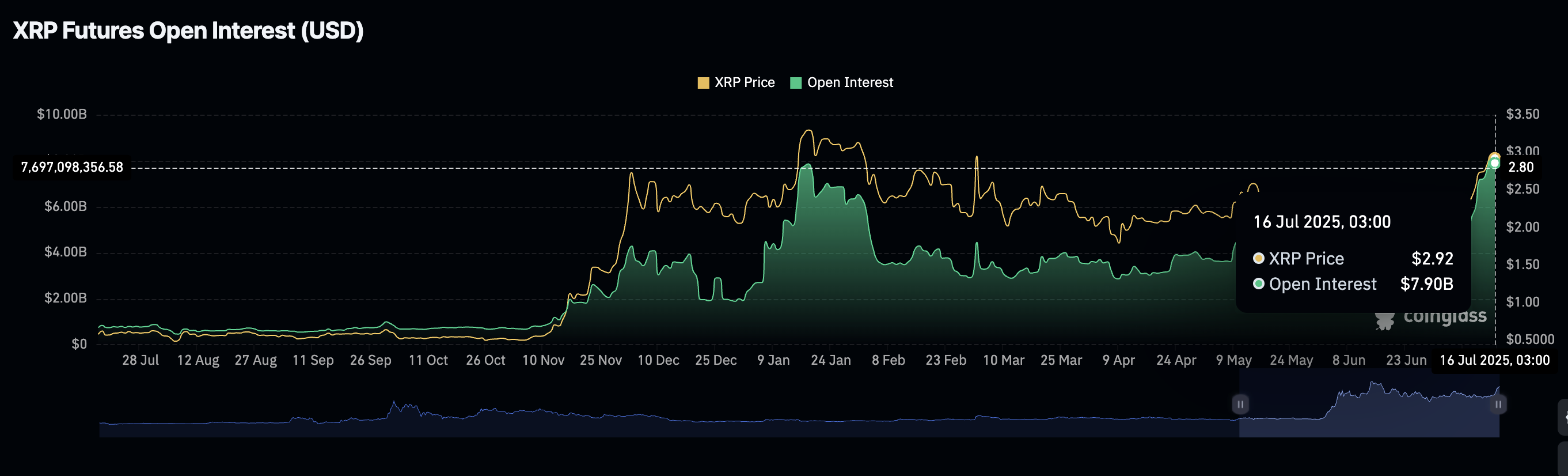

Meanwhile, investor interest in XRP has remained steady over the last few weeks, with the futures contracts' Open Interest (OI) increasing from $3.54 billion on June 23 to $7.9 billion at the time of writing.

XRP Futures Open Interest data | Source: CoinGlass

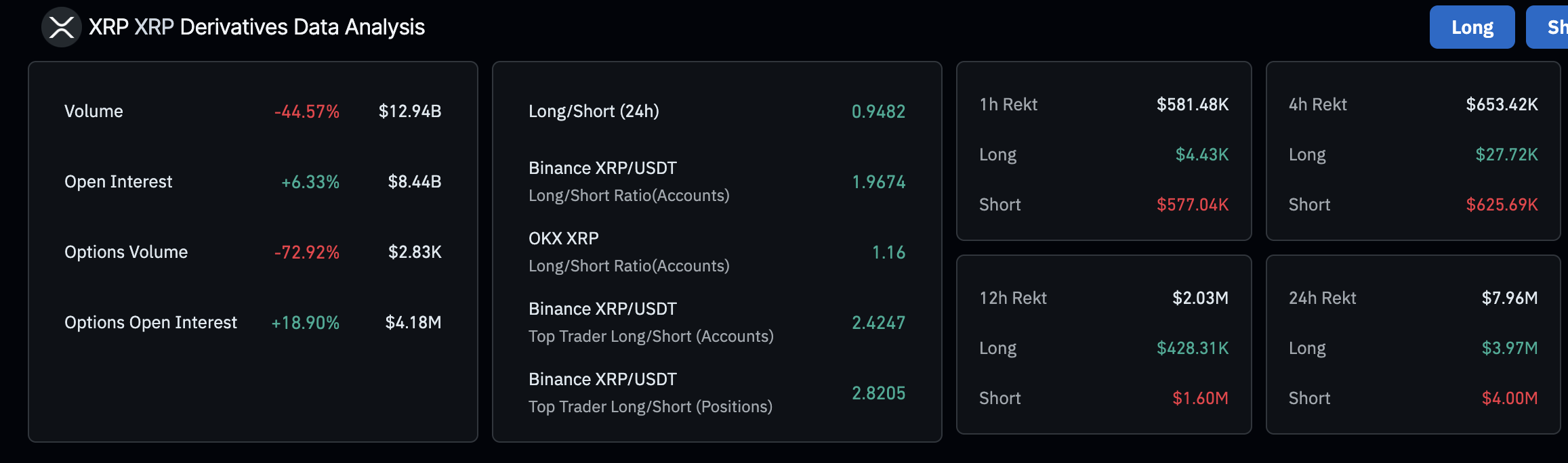

However, a 45% decline in the derivatives market volume to $13 billion over the past 24 hours reflects the instability that followed the rally above $3.00 on Monday and the immediate drop to the $2.80 support level. Low volumes indicate reduced market activity, which could hinder the steady increase in the XRP price.

XRP derivatives market stats | Source: CoinGlass

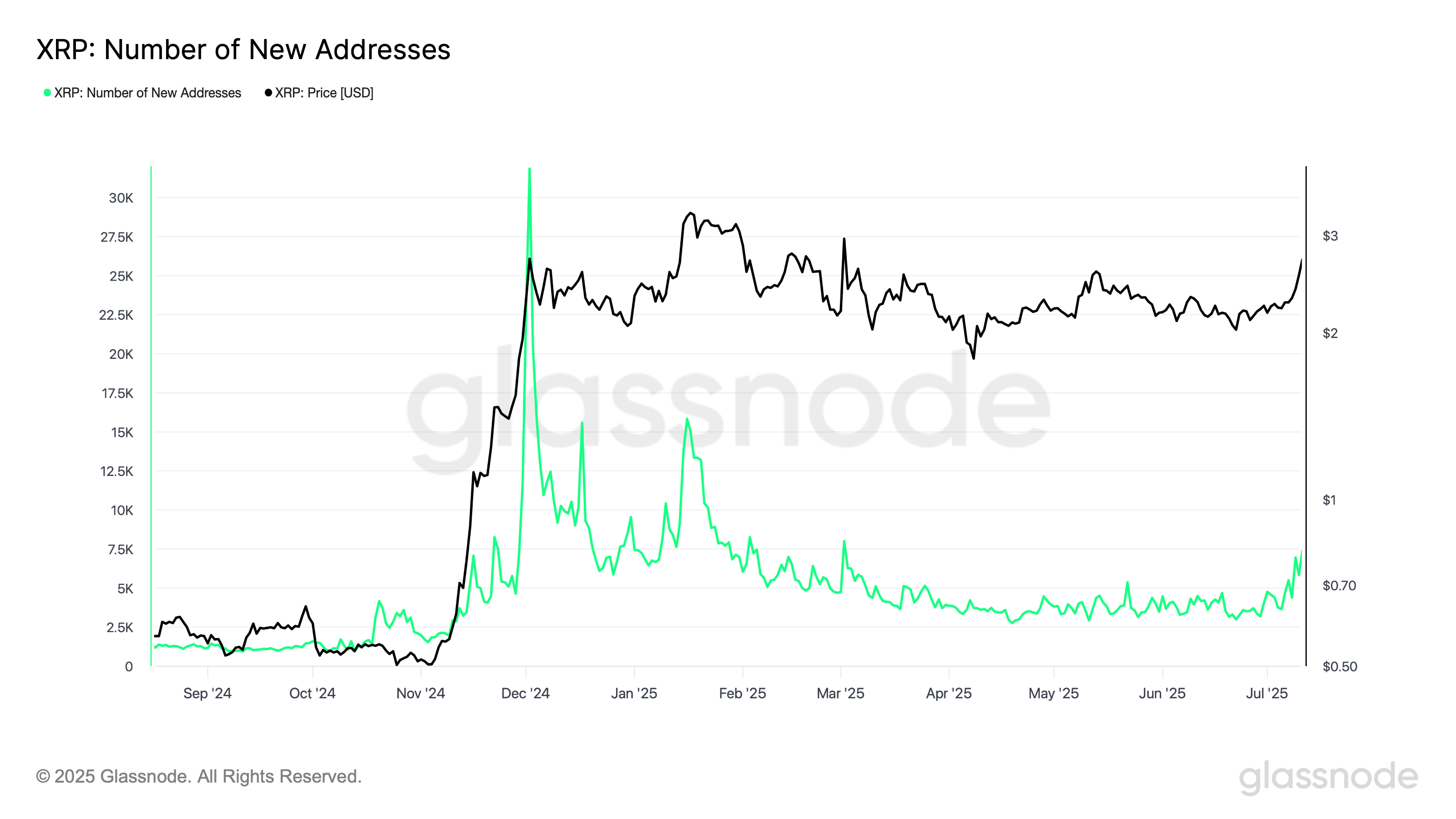

On the other hand, XRP is experiencing increasing adoption, as evidenced by the number of new addresses, which has reversed the downward trend after a drastic drop to 2,752 on April 19. Glassnode's New Addresses metric shows the number of new addresses joining the XRP Ledger averaged 8,690 on Monday. If this trend extends, it will signal a surge in the adoption and demand for XRP, and in turn, could boost the price toward record highs.

XRP Number of New Addresses metric | Source: Glassnode

Technical outlook: XRP upholds bullish outlook

The XRP price sits significantly above key moving averages, including the 50-day Exponential Moving Average (EMA) at $2.37, the 100-day EMA at $2.30, and the 200-day EMA at $2.16. All of these averages bolster the bullish outlook and could serve as support levels in the event of a trend reversal.

The Moving Average Convergence Divergence (MACD) indicator reinforces the bullish structure, upholding a buy signal since June 28. Traders may maintain exposure as long as the MACD line in blue stays above the red signal line.

A break and close above $3.00 would cement the bullish outlook and boost the probability of a breakout toward record highs of $3.40.

XRP/USDT daily chart

Still, with the Relative Strength Index (RSI) overbought at 81, caution is advised. Often, higher RSI readings above 70 signal a potential trend reversal as the market overheats. Hence, in the event the RSI slides below 70, the XRP price could claw back the gains accrued toward the 50-day EMA support at $2.37.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.