Crypto Today: SUI, Solana and Cardano among best performers as BTC tops $94K

- The cryptocurrency market capitalization rises 1% on Wednesday, breaching the $3 trillion mark for the first time in April.

- Bitcoin price extended gains to $94,200, setting new highs in each of the last three days of trading

- SUI leads altcoin gainers with a 20% uptick, while Cardano and Ethereum posted gains of 5% and 4%, respectively.

Bitcoin market updates:

- Bitcoin price gained 4% as it rallied towards $94,000 in the early hours of Wednesday. BTC has now set a new peak in three consecutive trading days since Monday

Chart of the day: Bitcoin ETFs record highest ever single-day inflows

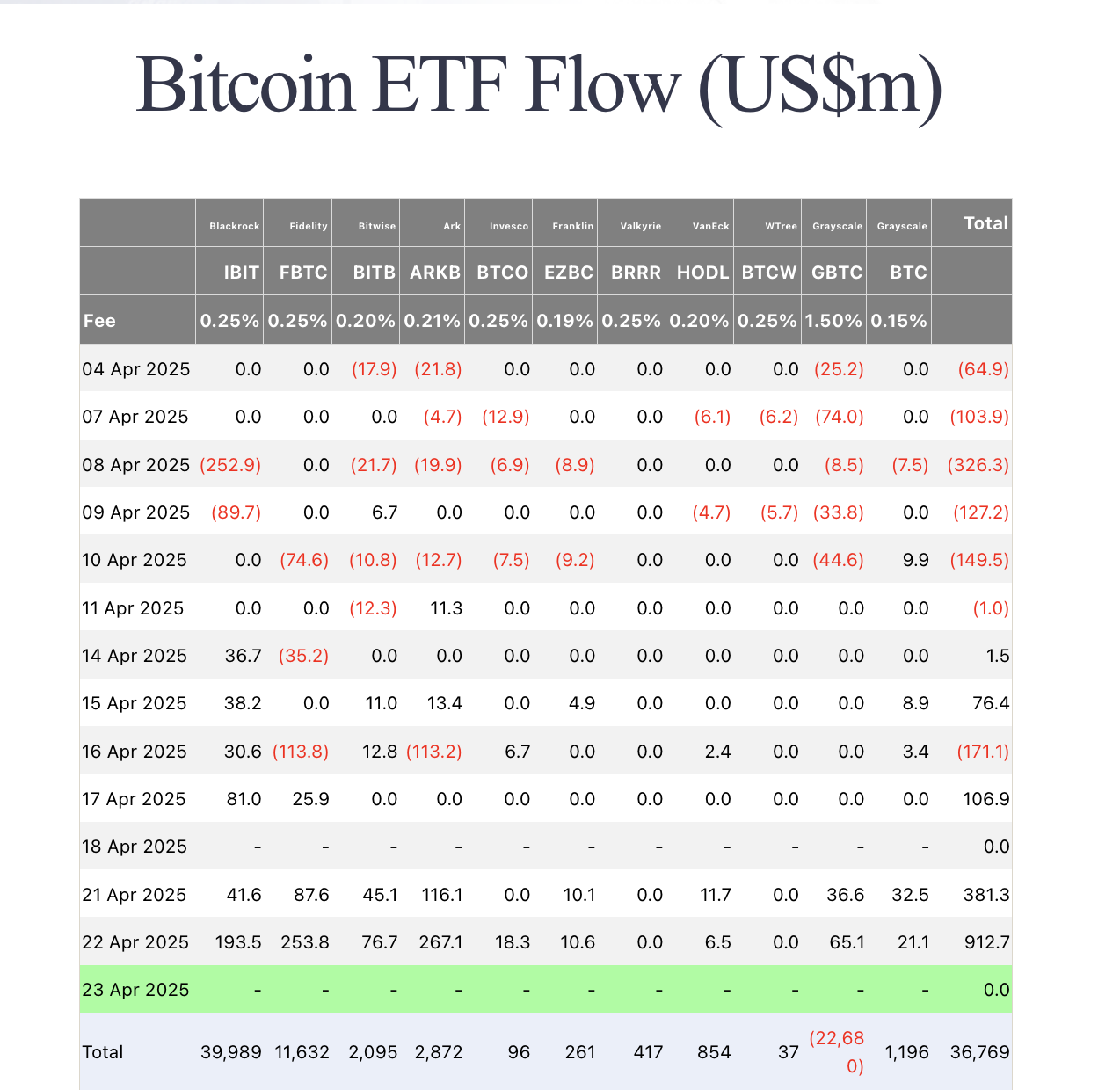

Bitcoin ETFs parked over $921 million in inflows on Tuesday, marking the highest single-day inflow since the US Securities and Exchange Commission (SEC) approved BTC ETFs for trading in January 2024.

Bitcoin ETF Flows | Source: Farside

It was Ark Invest’s ARKB that led the daily inflows for the second day running, with a $267 million net deposit. Meanwhile, Fidelity’s FBTC took in $253.8 million, beating BlackRock’s $193.5 million IBIT inflows, to third place.

This aligns with the narrative that Bitcoin continues to receive capital displaced from US stock

markets as the Trump administration’s reiterating a hard stance on tariffs.

Altcoin market updates: SUI, Cardano and Ethereum show strength in mixed trading session

The altcoin market showed a strong rebound in the latest session, led by SUI, which surged over 20% in 24 hours, marking one of the sharpest moves among mid-cap tokens. SUI’s rally appears driven by increased developer activity and speculative interest surrounding recent ecosystem announcements.

Cardano (ADA) followed with a 4.3% gain, extending its weekly performance to over 13%. ADA's price appreciation reflects renewed optimism surrounding its scaling upgrades and growing DeFi footprint, which have helped restore investor confidence. ADA is now approaching key resistance levels around $1, last seen in mid-March, with volume spikes supporting potential continuation.

Crypto market performance | Source: Coingecko

Ethereum (ETH), the second-largest crypto by market cap, gained 3.5% on the day to trade near $1,782.

Despite recent headwinds, including scalability concerns and ETH-SOL institutional rotation, ETH has reclaimed momentum.

This is evidenced by sustained buying interest and a modest recovery in DeFi staking activity.

In contrast, broader market sentiment remains cautious, with top altcoins like BNB and Tron (TRX) lagging with minor losses around 2% on the day.

Crypto news updates:

SEC charges PGI Global founder in $198 million crypto fraud scheme

The US SEC has filed charges against Ramil Palafox, founder of PGI Global, for orchestrating a fraudulent investment scheme that raised nearly $198 million from investors worldwide.

According to the SEC’s complaint, Palafox misappropriated more than $57 million to fund personal purchases, including multiple Lamborghini vehicles and other luxury goods.

The SEC alleges that the scheme operated under a Ponzi-like structure, with payouts to earlier investors funded by incoming investor money.

Palafox is accused of violating federal securities laws, including anti-fraud and registration provisions. The Commission is seeking permanent injunctions, the return of ill-gotten gains with interest, and civil penalties.

Gate.io to fully reimburse users affected by futures service interruption

Gate.io has announced it will offer full compensation to users who experienced losses during an emergency system upgrade of its futures trading platform.

The upgrade was initiated to expand the exchange’s contract services and was triggered by an unexpected surge in traffic.

As a result, futures trading and copy trading services were temporarily suspended. Spot trading, deposits, and withdrawals continued to operate without disruption.

The platform confirmed that the affected systems have since been restored and are now fully functional. Gate.io clarified that the compensation will cover system-related losses but will not extend to losses resulting from market price fluctuations.

At press time, the exchange has yet to release further details on how the compensation will be calculated or when it will be distributed.