ETH/BTC Hits 2020 Low: Whale Selling Pressure Intensifies

According to TradingView data, the ETH/BTC exchange rate recently dropped to 0.01791, marking its lowest level since 2020.

At the same time, selling pressure from “whales” in the Ethereum (ETH) market continues to escalate, with a series of large transactions executed by institutions like Galaxy Digital, Paradigm, and an address associated with the Ethereum Foundation.

ETH Whales Continue to Dump

Data from OnchainDataNerd on X reveals that Galaxy Digital transferred an additional 5,000 ETH (worth approximately $8.11 million) to Binance on April 22, 2025. Previously, BeInCrypto reported on April 18, 2025, that Galaxy Digital had transferred nearly $100 million worth of ETH to exchanges within a few days, sparking speculation about a potential large-scale sell-off.

Besides Galaxy Digital, Paradigm is also suspected of selling ETH, transferring 5,500 ETH (valued at around $8.65 million) to Anchorage Digital just 3 hours earlier, according to EmberCN on X. Additionally, an address linked to the Ethereum Foundation deposited 1,000 ETH (approximately $1.57 million) to the Kraken exchange, as noted by Lookonchain.

These actions from major institutions exert significant pressure on ETH’s price, particularly as the ETH/BTC ratio hits its lowest point since 2020.

ETH/BTC Decline: Market Sentiment Takes a Hit

The ETH/BTC ratio dropping to 0.01791 is a concerning signal for Ethereum. It indicates that ETH is losing value relative to Bitcoin (BTC). This decline partly stems from BTC’s price nearing $90,000.

ETH/BTC Ratio. Source: TradingView

ETH/BTC Ratio. Source: TradingView

Meanwhile, ETH is trading at $1,574, down 2.5% in the last 24 hours, according to BeInCrypto. This disparity may prompt investors to shift toward Bitcoin, further intensifying selling pressure on ETH.

Beyond the increased selling pressure from whales, the Ethereum Foundation has a history of selling ETH multiple times recently. This suggests that large transactions from institutions can significantly impact price volatility or hinder ETH’s growth to some extent.

In addition to whale pressure, Ethereum’s staking ratio currently stands at only 28%, significantly lower than competitors like Solana (65%). This could erode investor confidence, especially since ETH offers less attractive staking yields. Moreover, Bitcoin dominance (BTC.D), reaching a 4-year high, indicates that the capital is flowing away from ETH and other altcoins.

Ethereum’s Future: Correction or Decline?

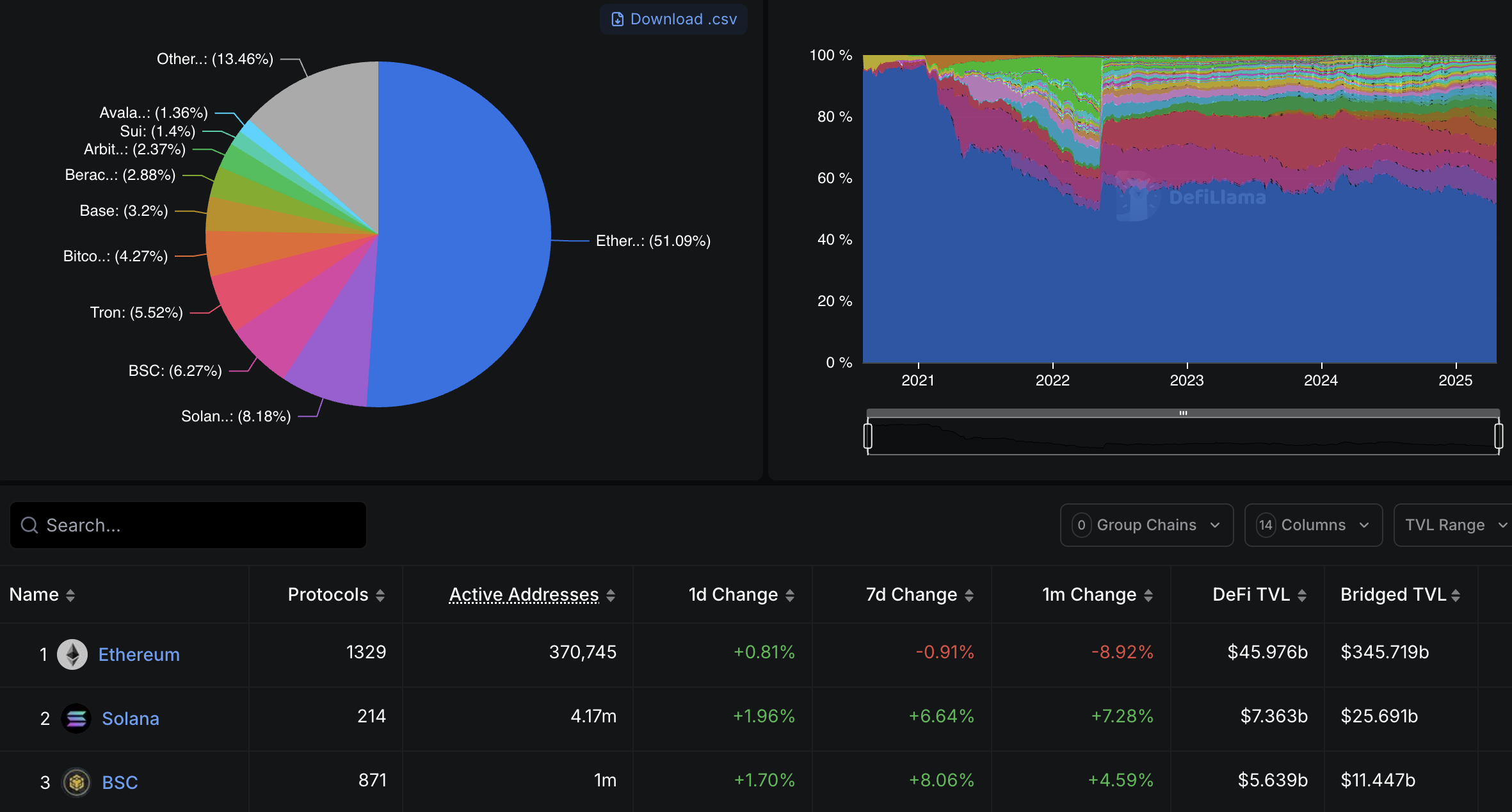

Despite the current selling pressure raising concerns, some experts remain optimistic about Ethereum’s long-term prospects. According to DefiLlama, Ethereum continues to lead as the top platform for DeFi and NFT applications, with a total value locked (TVL) exceeding $45 billion as of April 2025. Furthermore, upgrades like Ethereum 2.0 and the full transition to Proof-of-Stake could enhance ETH’s performance and attract investors in the future.

Ethereum is still the largest blockchain in terms of TVL. Source: DefiLlama

Ethereum is still the largest blockchain in terms of TVL. Source: DefiLlama

However, investors should exercise caution in the short term. If selling pressure from whales persists, ETH may face the risk of a deeper decline, especially since the ETH/BTC ratio shows no signs of recovery.