Solana, Consensys and Uniswap donated to Trump's $239 million inauguration fund

- Solana, Consensys and Uniswap CEO donated over $1.3M to Trump’s $239M inauguration fund.

- The SEC dropped investigations into Uniswap and Consensys weeks after the donations, raising concerns over timing and regulatory fairness.

- Other crypto firms –including Coinbase, Ripple, and Kraken– that donated to the fund also saw notable charges dropped.

United States (US) Securities and Exchange Commission (SEC) enforcement decisions follow $239 million in Donald Trump’s inaugural donations, including funds from top crypto firms Solana, Consensys, and Uniswap.

Crypto donations to Trump fund preceded end of SEC enforcement

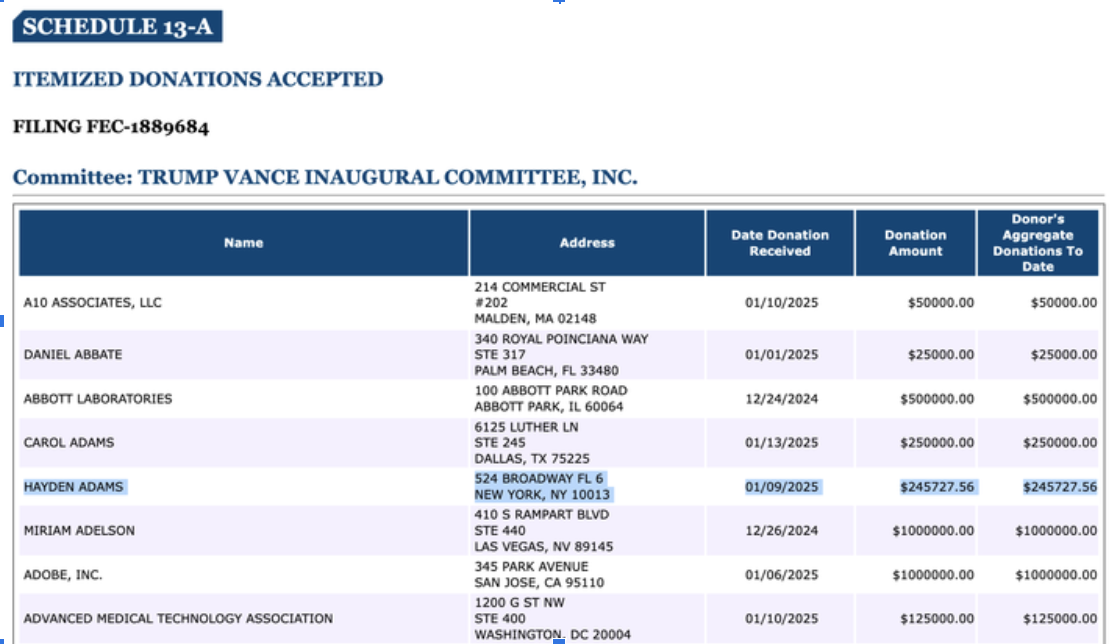

Recent Federal Election Commission (FEC) filings reveal that executives and entities tied to major blockchain firms—Solana Labs, Consensys, and Uniswap—contributed to President Donald Trump’s $239 million 2025 inauguration fund.

The contributions, disclosed on Sunday by the Trump-Vance Inaugural Committee, came just weeks before the SEC, under the new administration, reversed multiple high-profile enforcement actions involving those same companies.

Trump Vance Inauguaration Donations | Source: FEC.gov

According to the filings, Uniswap CEO Hayden Adams donated more than $245,000 in early January, Solana Labs contributed $1 million, and Consensys—developer of Ethereum infrastructure—provided $100,000.

The donations were part of a global corporate donations to the Trump-Vance inaugural fund, which also included support from Coinbase, Kraken, Ripple Labs, Ondo Finance, and Robinhood. These six crypto firms contributed a combined $9 million, while total inauguration donations hit $239 million, according to the FEC filings.

In February, the SEC officially dropped its long-running investigation into Uniswap Labs. Around the same time, Consensys founder Joseph Lubin announced that the agency had agreed to dismiss its pending lawsuit against the firm. These enforcement reversals occurred shortly after Trump took office on January 20 and appointed Commissioner Mark Uyeda as acting SEC Chair.

Regulatory rollback stirs concerns amid rising crypto-political ties

While the timing of the donations and the SEC’s subsequent actions have raised eyebrows in political and financial circles, the lack of formal inquiries has led to the matter. The Trump administration has framed the regulatory shift as part of a broader deregulatory agenda aimed at fostering blockchain innovation and US competitiveness in crypto markets.

In parallel, the SEC signaled it would also halt enforcement actions against other crypto entities that contributed to the inaugural fund, including Coinbase and Kraken, two firms that have faced ongoing litigation over securities compliance. The regulatory reversals are being closely watched by lawmakers as Congress debates comprehensive cryptocurrency legislation, particularly around stablecoins and decentralized finance (DeFi)

Adding to scrutiny is the emergence of Trump-affiliated crypto ventures. In January, the Trump family launched a Solana-based memecoin and later backed World Liberty Financial, a stablecoin issuer developing a US Dollar-pegged crypto token.

These donations, coinciding with dropped charges, have prompted bipartisan calls for clearer rules on political engagement and financial conflict of interest in cryptocurrency markets.