Bitcoin mining hashrate declines amid Bitdeer's plan to begin self-mining operations

- Bitdeer Technologies plans to begin self-mining operations due to US trade uncertainties.

- The company intends to capitalize on President Trump's 90-day tariff pause to ship equipment into the US.

- Bitcoin's mining hashrate declined as Trump tariffs kicked in, with US miners facing high mining costs.

Bitcoin (BTC) mining hardware manufacturer Bitdeer is preparing to launch its own mining operations in the United States (US), according to Bloomberg. The company intends to expedite equipment shipments following President Donald Trump's announcement of a 90-day pause on tariffs. Additionally, the pressure from tariffs has led to a decrease in Bitcoin mining hashrate among US miners over the past month.

Bitdeer prepares for self-mining amid drop in mining activity

Bitdeer is ramping up efforts to begin self-mining operations following a decline in demand for mining hardware. The company intends to use its mining rigs to mine Bitcoin for itself instead of selling to other miners.

"Our plan going forward is to prioritize our own self-mining," said Jeff LaBerge, head of capital markets and strategic initiatives at Bitdeer.

The move comes as the global supply chain market experienced shocks from rising trade tensions between the US and China — which hosts the manufacturing of most mining hardware.

Self-mining operations could place Bitdeer as a strong competitor to other mining companies in the US, particularly as trade tensions have heightened mining costs.

Miners previously scurried to beat potential hikes in the price of Bitcoin mining equipment before the US trade tariffs went live, leading many to pay inflated amounts to move the hardware into the country.

Meanwhile, Bitdeer is planning to start manufacturing mining equipment in the US with the aim of reducing supply chain vulnerabilities while localizing production.

To accomplish this, the company has begun to capitalize on the 90-day pause on tariffs to ship equipment from Southeast Asia into the US.

The Securities and Exchange Commission (SEC) clarified last month that proof-of-work mining is not considered securities offerings and does not require registration under the Securities Act or Exchange Act.

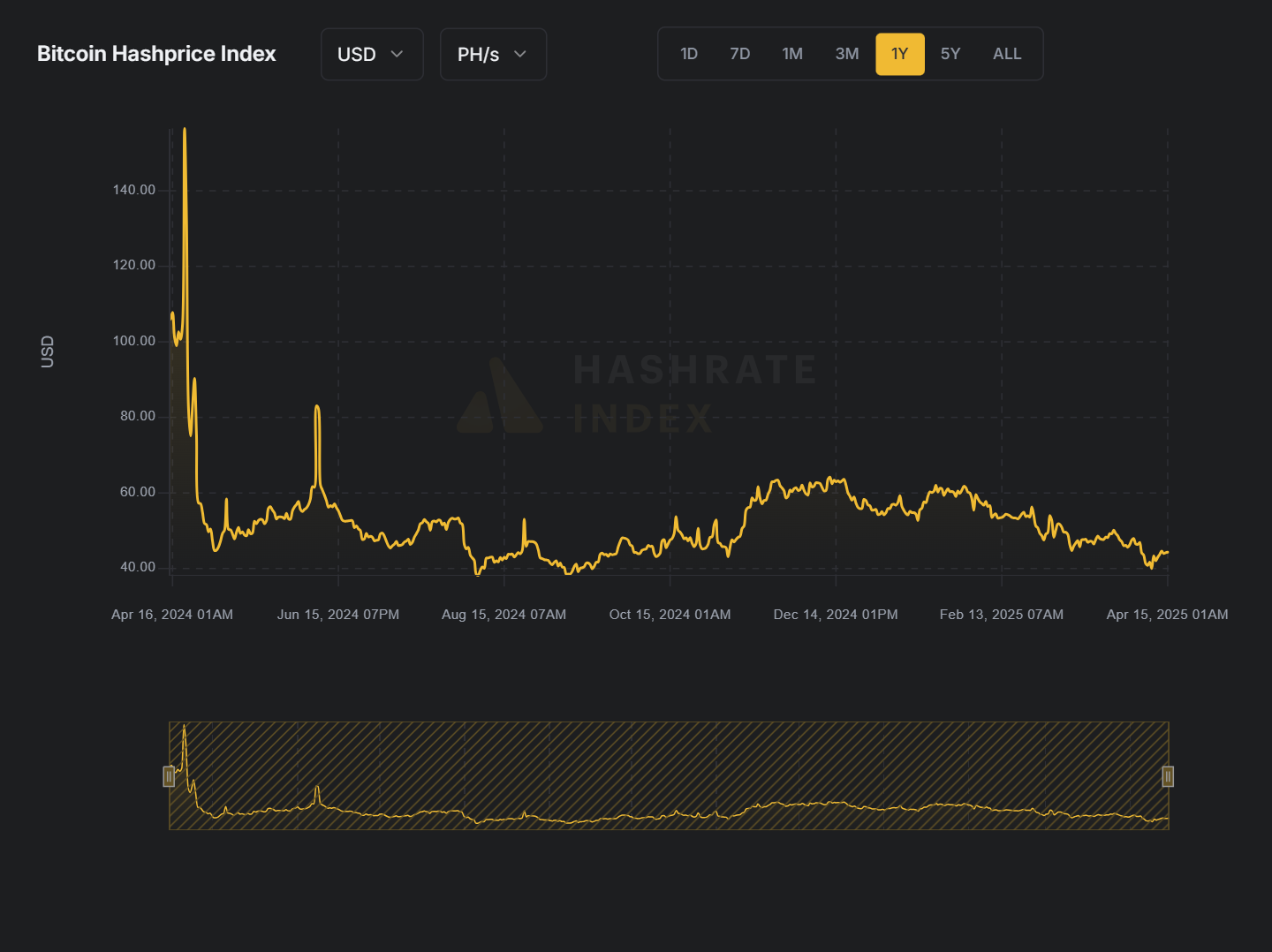

Bitdeer's effort follows a decline in Bitcoin mining hashrate due to a hike in the cost of mining. Bitcoin's hash price, which is a key indicator of mining profitability, dropped to near-record lows last week before seeing a slight recovery, according to data from the Hashrate Index.

BTC hash price. Source: Hashrate Index

However, activity surrounding mining companies increased in March, including Eric Trump's partnership with Hut 8 Mining to launch a new Bitcoin mining company called American Bitcoin.

Marathon Digital also announced a $2 billion equity offering. The company intends to use the proceeds to acquire more Bitcoin and support general corporate needs.