The entire global economy and all financial markets are now at the mercy of the US bond market

The US bond market is the one thing running the show right now. It doesn’t care who the president is, what the Fed says, or how loud traders scream on the NYSE floor after opening bell.

Everything—crypto, stocks, tech, commodities, entire economies—is locked into whatever direction Treasuries decide to go. And right now, things are looking ugly.

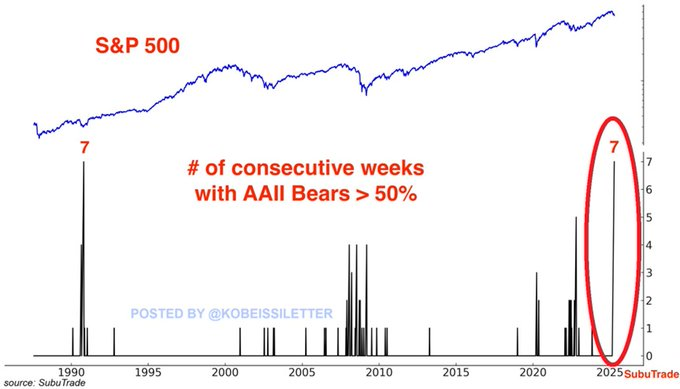

Bearish sentiment just hit insane levels. In the week ending April 9, the AAII survey showed 58.9% of individual investors expect the stock market to fall over the next six months. That number was even higher the week before—61.9%.

For context, during the worst of the 2008 financial crisis, that number peaked at 70.3%. During the 2022 bear market, it hit 60.8%. Right now, we’ve had seven straight weeks with a bearish sentiment of over 55%. That matches the longest stretch ever, which was back in 1990. Not even in 2008 did people stay this negative for this long.

Yields swing after tariff chaos hits bonds

The 10-year Treasury yield dropped hard on Monday. It fell about 9 basis points, landing at 4.403%. The 2-year note wasn’t far behind, sliding to 3.918%. That sounds small, but a basis point is just 0.01%.

President Donald Trump had announced on Saturday that smartphones, computers, chips, and other electronics are temporarily safe from the so-called reciprocal tariffs. His administration said companies need time to move production back to the US.

But on Sunday, Trump’s Commerce Secretary Howard Lutnick said this isn’t permanent, only for Trump himself to now come out a short while after and basically say that wasn’t true. The uncertainty only got worse.

Before that, the 10-year yield had exploded by more than 50 basis points in just two days. That kind of jump doesn’t happen often. It was one of the sharpest two-day spikes ever. Even after Trump paused new tariffs for 90 days, yields didn’t chill. The 10-year dropped briefly, then rocketed back past 4.5% by Friday. No one knew what was going on.

Some traders started whispering that foreign players—like China and Japan—might dump their US Treasury holdings. If that happens, good luck. These countries own trillions in bonds. Selling even a small piece would crush the market.

Trump, as usual, acted like everything was fine. “The bond market’s going good,” he told reporters. “It had a little moment, but I solved that problem very quickly. I am very good at that stuff.”

Every single word of that statement is inaccurate, by the way. The bond market didn’t just have a “moment.” It had a meltdown. He didn’t “solve” it. He triggered it. And no, nothing was “very quickly” resolved.

Stocks react to tariff moves but still bleed

Back to Wall Street, stocks went full rollercoaster. Monday opened strong after Trump’s tariff exemption announcement. The Dow Jones jumped 300 points, or 0.8%. The S&P 500 and Nasdaq climbed about 0.9%. Big tech names led the rally—Apple popped more than 3%. Dell surged over 5%. The XLK tech ETF gained 1.5%.

But the bounce didn’t last. The CNBC Magnificent 7 Index, which tracks major tech giants, dropped around 3% not long after. Apple was one of the biggest losers, with nearly $640 billion in market cap gone in just three trading days, according to data from Google Finance.

Last week, the CBOE Volatility Index shot past 50 on Thursday. That’s high as hell. Traders were bailing on risky positions. One day earlier, markets had soared after Trump paused tariffs for 90 days. That rally was the third-biggest one-day jump since World War II. But within hours, all those gains vanished.

Meanwhile, Bitcoin, the king of cryptos, is still struggling to get out of its correction and has failed to properly reclaim $85,000. But interestingly, Bitcoin has held up better than all other assets, except perhaps gold.