The Benner Cycle: Can This 150-Year-Old Chart Predict the Next Crypto Market Peak?

Many retail investors use predictive tools to make their investment strategies in today’s unstable global financial landscape. One tool that has gained widespread attention recently is the Benner Cycle.

This economic forecasting chart is over 150 years old. Many believe it has accurately predicted major financial crises since the mid-1920s. However, recent economic developments are putting that belief to the test.

When Does the Benner Cycle Predict a Market Peak?

Samuel Benner suffered heavy losses during the 1873 crisis. Afterward, he began studying economic patterns and published a book documenting asset price rises and falls. In 1875, he wrote Business Prophecies of the Future Ups and Downs in Prices, introducing the Benner Cycle.

This cycle doesn’t rely on complex mathematical models from quantitative finance. Instead, Benner based it on the price cycles of agricultural goods, which he observed through his own experience.

At the end of his findings, Benner—then a farmer—left a note: “Sure thing.” Nearly two centuries later, that note is resurfacing and gaining interest again.

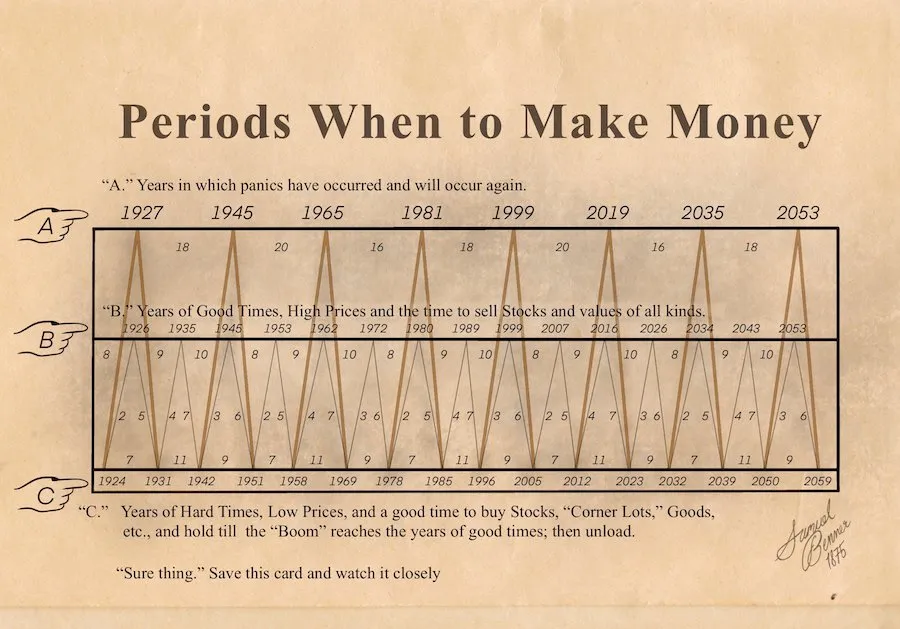

Benner Cycle. Source: Business Prophecies of the Future Ups and Downs in Prices

Benner Cycle. Source: Business Prophecies of the Future Ups and Downs in Prices

Using his farmer’s perspective, Benner believed that solar cycles significantly impacted crop yields, which in turn influenced agricultural prices. From this idea, he created a market prophecy.

In the Benner chart:

- Line A marks years of panic.

- Line B indicates boom years, which are good for selling stocks and assets.

- Line C highlights recession years, which are ideal for accumulation and buying.

Benner mapped his forecast to 2059, even though modern agriculture has changed dramatically in the nearly 200 years since.

According to Wealth Management Canada, although the cycle doesn’t predict exact years, it has closely aligned with major financial events—such as the Great Depression of 1929—with only minor deviations of a few years.

Investor Panos noted that the Benner Cycle successfully forecasted several key events: the Great Depression, World War II, the Dot-Com bubble, and the COVID-19 crash. The chart also suggests that 2023 was a prime year to buy, and 2026 will mark the market’s next major peak.

“2023 was the best time to buy in recent times and 2026 would be the best time to sell,” Panos emphasized.

Retail investors in the crypto market share this chart widely, using it to support bullish scenarios for 2025–2026.

“Benner’s cycle suggests a market peak around 2025, followed by a correction or recession in subsequent years. If it holds true, the speculative hype in Crypto AI and emerging tech could intensify in 2024–2025 before a downturn,” Investor mikewho.eth predicted.

Belief in the Benner Cycle Faces Growing Challenges

Despite the growing popularity, belief in the Benner Cycle is under pressure due to recent economic developments.

On April 2, President Trump announced a controversial new tariff plan. Global markets reacted negatively, opening the week deep in the red.

The market movements on April 7 were so severe that some dubbed it “Black Monday” over the infamous stock crash in 1987. On April 7, the total crypto market cap dropped from $2.64 trillion to $2.32 trillion. Although a recovery has started, investor sentiment remains deeply fearful.

In addition, JPMorgan recently increased its probability of a global recession in 2025 to 60%. This shift was triggered by the economic shock caused by the newly announced tariffs on Liberation Day. Goldman Sachs also raised its recession forecast to 45% over the next 12 months—the highest level since the post-pandemic era of inflation and rate hikes.

Veteran trader Peter Brandt criticized the Benner chart in a post on X (formerly Twitter) on April 7, 2025.

“I do not know how much I would trust this. Ultimately I need to deal with only the trades I enter and exit. This type of chart is more distracting than anything for me. I cannot go short or long this specific chart, so it is all lala land for me,” Peter commented.

Still, despite concerns about a recession and market behavior contradicting the Benner Cycle’s bullish outlook, some investors believe in Samuel Benner’s prophecy.

“Market top in 2026. That gives us one more year if history decides to repeat itself. Sounds wild? Sure. But remember: markets are more than just numbers; they’re all about mood, memory, and momentum. And sometimes those quirky old charts work—not because they’re magical, but because enough folks believe they do!” — Investor Crynet said.

Search Trends For The Keyword “Benner Cycle”. Source: Google Trend

Search Trends For The Keyword “Benner Cycle”. Source: Google Trend

According to Google Trends, search interest in the Benner Cycle peaked over the past month. This reflects a growing demand among retail investors for optimistic narratives, especially amid fears of heightened economic and political instability.