Can the Federal Reserve’s Interest Rate Cuts Revive Crypto Markets?

The Federal Reserve is having a closed-door meeting today to discuss potentially cutting interest rates. This would help crypto in a few ways, spurring risky investments and possibly even weakening the dollar.

Fed Chair Jerome Powell has been hesitant to cut rates, but he is under a lot of pressure. BlackRock’s CEO Larry Fink is currently pessimistic about rate cuts, claiming that they may even increase this year.

Will the Fed Consider Rate Cuts?

Trump’s tariff threats have the entire market in freefall, as billions have been liquidated from crypto and TradFi alike. The rumor of a 90-day pause on tariffs caused a dramatic rally earlier today.

Soon after, the White House denied the rumors, resulting in a crash. However, the Federal Reserve is having a closed-door meeting today, and it may plan to cut interest rates:

“A closed meeting of the Board of Governors of the Federal Reserve System at will be held 11:30 am on Monday, April 7, 2025. The following matters of official Board business are tentatively scheduled to be considered at that meeting: review and determination by the Board of Governors of the advance and discount rates to be charged by the Federal Reserve Banks,” the Fed’s website read.

There are many reasons why the Federal Reserve could cut interest rates. High rates make fixed-income investments more attractive, drawing capital away from riskier assets like stocks and cryptocurrencies, while low rates make these assets more attractive.

Rate cuts have often corresponded with market rallies, especially with ZIRP after the 2008 crash.

Now that most of the market is predicting a recession, the Federal Reserve could cause a rally with these rate cuts. The crypto market recently hoped for rate cuts, which the FOMC quickly rejected.

Fed Chair Jerome Powell initially signaled that he was reluctant to cut rates at this moment, but pressure has been building for him to do so. Unfortunately, that may not matter yet.

Larry Fink, BlackRock’s pro-crypto CEO, has been very pessimistic about possible cuts. In a recent televised interview, he claimed that most CEOs believe the US is already in a recession and that the country is currently not a “global stabilizer” in the markets.

Under these conditions, he stated that there’s a 0% chance of 4 to 5 rate cuts and that rates may even increase.

Are Interest Rate Cuts Always Bullish for Crypto?

When the Federal Reserve cuts interest rates, it isn’t a bullish signal across the board. They also tend to weaken the US dollar as its yield advantage diminishes relative to other currencies.

This would also be good for crypto, considering its use as a store of value, but the Fed isn’t particularly interested in that. The industry won’t be the deciding factor either way.

Still, other commentators have been highly skeptical of Fink’s claim. Powell is under a lot of pressure to cut rates, so raising them would buck market expectations. Investors are betting on multiple rate cuts, and these hypothetical cuts may be priced to a certain extent.

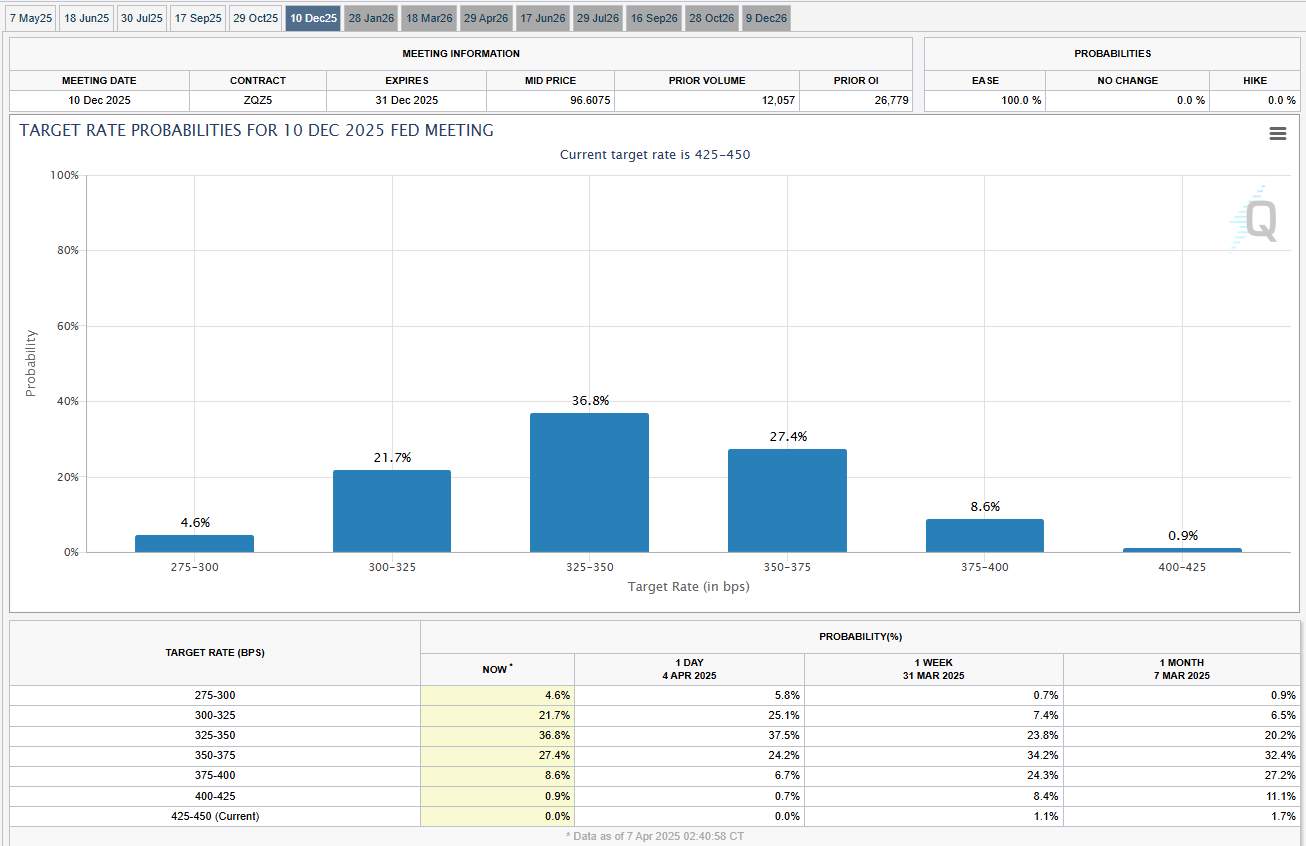

Fed Interest Rate Cut Projection 2025. Source: CME FedWatch

Fed Interest Rate Cut Projection 2025. Source: CME FedWatch

Looking back at previous cycles, periods of rate cuts have often coincided with market rallies. For instance, during the post-2008 recovery, rate cuts revived equity and emerging asset classes.

Overall, lower rates typically mean easier access to credit, leading to more liquidity in the market. This extra liquidity can help drive up demand for riskier assets, including cryptocurrencies.

So, If the FOMC signals a shift toward lower interest rates, this could boost overall market confidence. As traditional markets begin to stabilize and recover, crypto markets might experience a rebound.

Investor sentiment, already shaken by the recent sell-offs and heightened volatility, could turn more optimistic with the prospect of easing monetary conditions.

Most importantly, institutional investors, who have been cautious during the current volatile period, may adjust their strategies in a lower-rate environment.

With lower fixed-income yields, portfolio managers could increase their allocation to alternative assets, including cryptocurrencies, to achieve higher returns. This influx of institutional capital could lend credibility to the crypto market and help drive a recovery.