Cardano’s Death Cross Spells Trouble as ADA Sinks to November Lows

Cardano (ADA) has faced a sharp price decline amid heightened volatility and widespread liquidations across the broader crypto market. Over the past 24 hours, ADA has shed more than 10% of its value, marking one of its steepest single-day losses in recent months.

ADA is now trading at $0.52, levels last seen in November 2024. This reinforces the growing bearish sentiment against the altcoin.

Death Cross and Heavy Outflows Weigh on ADA

ADA’s downturn in the past day has pushed its price into precarious territory, with a death cross now appearing on its daily chart. This marks the first time the pattern will appear on ADA charts since May 2024.

ADA Death Cross. Source: TradingView

ADA Death Cross. Source: TradingView

The death cross pattern—where the 50-day moving average falls below the 200-day moving average—is viewed as a long-term bearish signal, often preceding extended periods of price weakness.

When a death cross is formed, it indicates a definitive shift in market sentiment from bullish to bearish, leading to increased selling pressure and a possible further decline in price. This suggests ADA could face continued downward pressure in the near term if the bulls remain in the shadows.

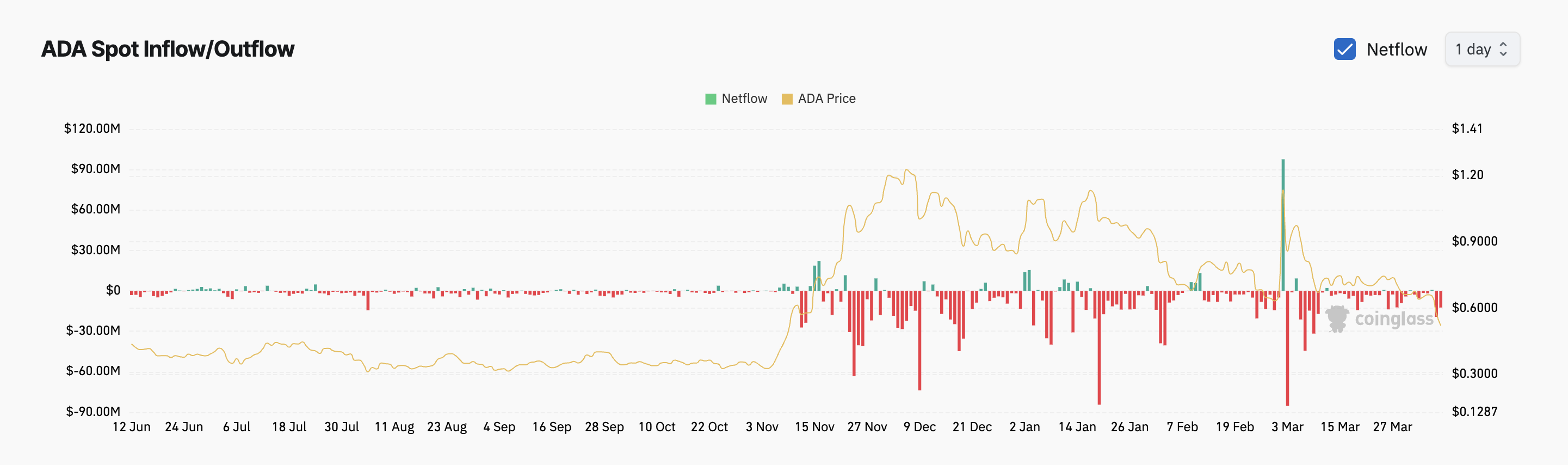

Moreover, the steady outflows from the ADA spot markets add to the downward pressure on its price. According to Coinglass, ADA spot outflows have totaled $12 million so far today.

Over the past month, capital exit from the ADA spot markets has exceeded $150 million.

ADA Spot Inflow/Outflow. Source: Coinglass

ADA Spot Inflow/Outflow. Source: Coinglass

Spot outflows like this indicate bearish sentiment, as they suggest that investors are pulling their capital in anticipation of further price drops or moving funds into other assets.

This persistent trend signals a loss of confidence among ADA traders as they continuously liquidate their positions. This has worsened the market’s selling pressure and contributed significantly to ADA’s price troubles.

Cardano’s Downward Trend Deepens: Death Cross Threatens More Drop

While broader market instability has impacted many altcoins, ADA’s price drop is notable due to the formation of the Death Cross. The emergence of this technical indicator, combined with a multi-month price low as buying activity falls, suggests ADA could face continued downward pressure in the near term.

In this scenario, its value could dip to $0.44, marking a 14% decline from its current value.

ADA Price Analysis. Source: TradingView

ADA Price Analysis. Source: TradingView

On the other hand, a resurgence in new demand for the altcoin will invalidate this bearish outlook. In that scenario, ADA’s price could regain its losses and attempt to break above resistance at $0.54.

If successful, it could extend its gains to $0.64.