Coinbase Pushes XRP Futures Amid Illinois Lawsuit Relief

Coinbase filed with the US Commodity Futures Trading Commission (CFTC) to launch futures contracts for Ripple’s XRP token.

The move comes after a positive development for the crypto derivatives market in the US, reflecting shifting regulatory ties in the country.

Coinbase Files for XRP Futures Trading With CFTC

Coinbase Derivatives has submitted a filing to self-certify XRP futures. It will provide a regulated, capital-efficient means for market participants to gain exposure to XRP. The new contract could go live as soon as April 21.

“We’re excited to announce that Coinbase Derivatives has filed with the CFTC to self-certify XRP futures – bringing a regulated, capital-efficient way to gain exposure to one of the most liquid digital assets. We anticipate the contract going live on April 21, 2025,” read the announcement.

Meanwhile, the official filing indicates that the XRP futures contract will be a monthly cash-settled and margined contract trading under the symbol XRL.

Each contract represents 10,000 XRP and will be settled in US dollars. Trading will be available for the current month and two subsequent months. As a protective measure, trading will be temporarily halted if the spot XRP price moves more than 10% within an hour.

XRP Price Performance. Source: BeInCrypto

XRP Price Performance. Source: BeInCrypto

The Coinbase Exchange also confirmed that it has engaged with Futures Commission Merchants (FCMs) and other market participants. Both references reportedly expressed support for the launch.

However, Coinbase is not the first US-based exchange to introduce regulated XRP futures. In March, Chicago-based Bitnomial launched what it advertised as the country’s first CFTC-regulated XRP futures contract.

For Coinbase, however, the boldness comes after the CFTC eased key regulatory hurdles for crypto derivatives trading. As BeInCrypto reported, this signaled a more accommodating stance towards the sector.

“Pursuant to Commodity Futures Trading Commission (“CFTC” or “Commission”) Regulation 40.2(a), Coinbase Derivatives, LLC (the “Exchange” or “COIN”) hereby submits for self-certification its initial listing of the XRP Futures contract to be offered for trading on the Exchange…,” an excerpt in the filing indicated.

This suggests that the commodities regulator’s shift, revoking previous crypto-related guidelines, may boost institutional confidence. For XRP, this development bolsters confidence in the asset’s previously contentious status following Ripple’s recent regulatory breakthrough.

“Coinbase Derivatives’ filing with the CFTC to self-certify XRP futures aims to legitimize XRP trading by offering a regulated, capital-efficient product for investors,” one user remarked.

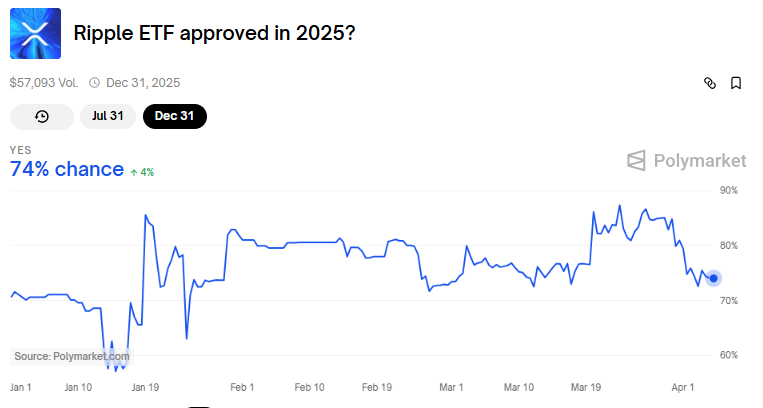

The futures contract might also help the odds of XRP ETF approval. Recently, the SEC delayed several applications to create one, and its status is in limbo.

XRP ETF approval odds. Source: Polymarket

XRP ETF approval odds. Source: Polymarket

Data on Polymarket shows bettors see a 74% chance for XRP ETF approval in 2025 and a more modest 34% by July 31.

Regulatory and Legal Developments Favor Coinbase

Elsewhere, the timing of this filing aligns with recent favorable regulatory developments for Coinbase. Reports suggest Illinois intends to drop its lawsuit against the exchange over its staking services.

Up to 10 states filed a lawsuit against Coinbase in June 2023 alleging that its staking program constituted unregistered securities offerings.

This recent development makes Illinois the fourth state to withdraw legal action against Coinbase. Vermont, South Carolina, and Kentucky also dismissed their cases on March 13, 27, and 31, respectively.

However, the cases remain active in Alabama, California, Maryland, New Jersey, Washington and Wisconsin.

These legal retreats coincide with the US SEC’s (Securities and Exchange Commission) February decision to abandon its federal lawsuit against Coinbase. BeInCrypto reported that this development marked a broader shift in the regulatory approach under the current administration.

“Regulators are losing steam, and Coinbase is stacking quiet courtroom wins. Staking’s future in the US might just be back on track,” a user commented.

Illinois’ decision to drop its lawsuit comes as the state advances a Bitcoin strategic reserve bill. Specifically, Illinois State Representative John M. Cabello introduced House Bill 1844 (HB1844), highlighting Bitcoin’s potential as a decentralized, finite digital asset.

“A strategic bitcoin reserve aligns with Illinois’ commitment to fostering innovation in digital assets and providing Illinoisans with enhanced financial security,” the bill read.