Bitcoin Top Buyers Preferring To Hold Rather Than Sell, Glassnode Reveals

The on-chain analytics firm Glassnode has explained how the investors who bought at the Bitcoin top are showing conviction, not capitulation.

3 To 6 Months Old Bitcoin Buyers Have Been Holding Strong Recently

In a new post on X, the on-chain analytics firm Glassnode has discussed a couple of Bitcoin investor cohorts. One of these groups is the “long-term holder” (LTH) cohort, which includes the BTC investors who bought their coins more than 155 days ago.

Statistically, the longer a holder keeps their coins dormant, the less likely they become to move the coins at any point. As such, the LTHs with their appreciable holding time represent the resolute side of the market.

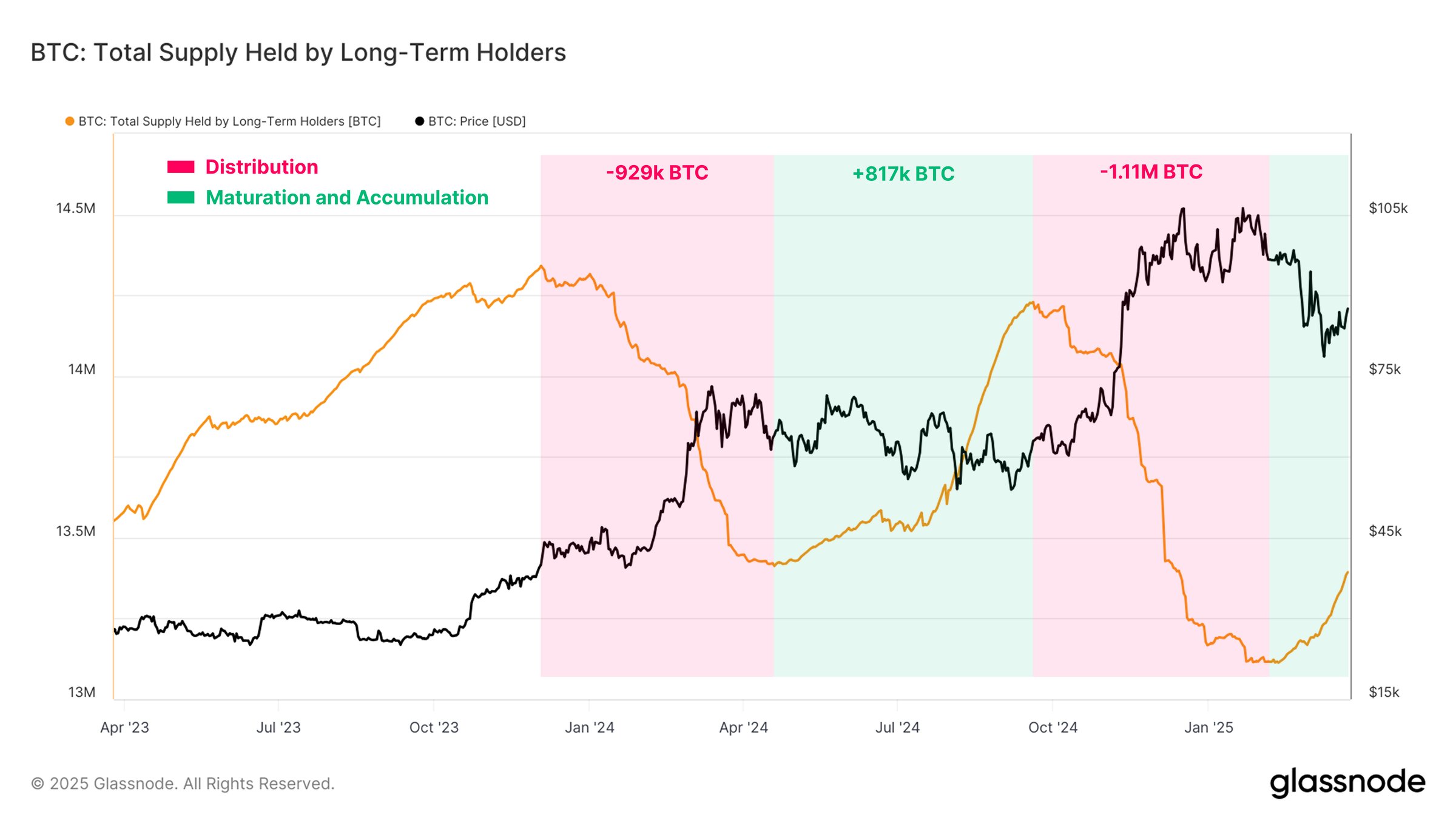

Though, while these investors can be termed as ‘diamond hands,’ it’s not as if they never participate in any selling at all. In fact, during two selling waves in the current cycle alone, the group has done a total distribution of 2 million BTC.

From the above graph, it’s visible that the first LTH selloff was followed by a period of re-accumulation, which brought the group’s supply back to almost the same level as before the distribution wave.

The second distribution phase, which occurred between October 2024 and January 2025, is also similarly being followed by an accumulation wave, as the LTH supply has been rising during the last couple of months. “This cyclical balance may be stabilizing price action,” notes the analytics firm.

Something to note is that whenever the LTH supply rises, it doesn’t represent any buying that’s occurring in the ‘now.’ Rather, it shows that some accumulation occurred 155 days ago and those coins have now been held long enough to become a part of the cohort.

This five-month cutoff puts the latest LTH acquisition point at the end of November, which means that the recent increase in the indicator correlates to buying that occurred during the BTC rally to prices beyond $90,000. Many of the November buyers should now be in the red, but these investors have continued to hold nonetheless, earning their title as HODLers.

A segment of investors that should be under more intense pressure is the 3-month to 6-month group. This cohort represents the holders who are transitioning into the LTHs. Many of these investors would have bought at or near the price all-time high (ATH), so they could be notably underwater today.

Interestingly, these investors have been showcasing strong conviction recently, as the amount of wealth held by them has only been rising while the Bitcoin price continues to struggle.

Naturally, the weak hands who got in during the Bitcoin top would have already capitulated long ago and never matured into the 3 months to 6 months range, but it’s still significant that those who are left aren’t shaken by the market volatility.

BTC Price

At the time of writing, Bitcoin is trading at around $84,300, down more than 3% in the last seven days.