Crypto market sheds over $130B in market cap on Trump tariff uncertainties

- The crypto market lost over $130 billion in market capitalization last week.

- Major cryptocurrencies like BTC, ETH, XRP, and SOL fell 5.9%, 10.9%, 15% and 10.1%, respectively.

- The Kobeissi letter report highlights that US tariffs will impact $1.5+ trillion of imports by the end of April.

The crypto market lost over $130 billion in market capitalization the previous week. Major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Solana (SOL) fell 5.9%, 10.9%, 15% and 10.1%, respectively, according to CoinGecko data. The upcoming US President Donald Trump’s tariff will impact $1.5+ trillion of imports by the end of April, according to the Kobeissi letter report.

Crypto assets lost $130 billion in market cap last week

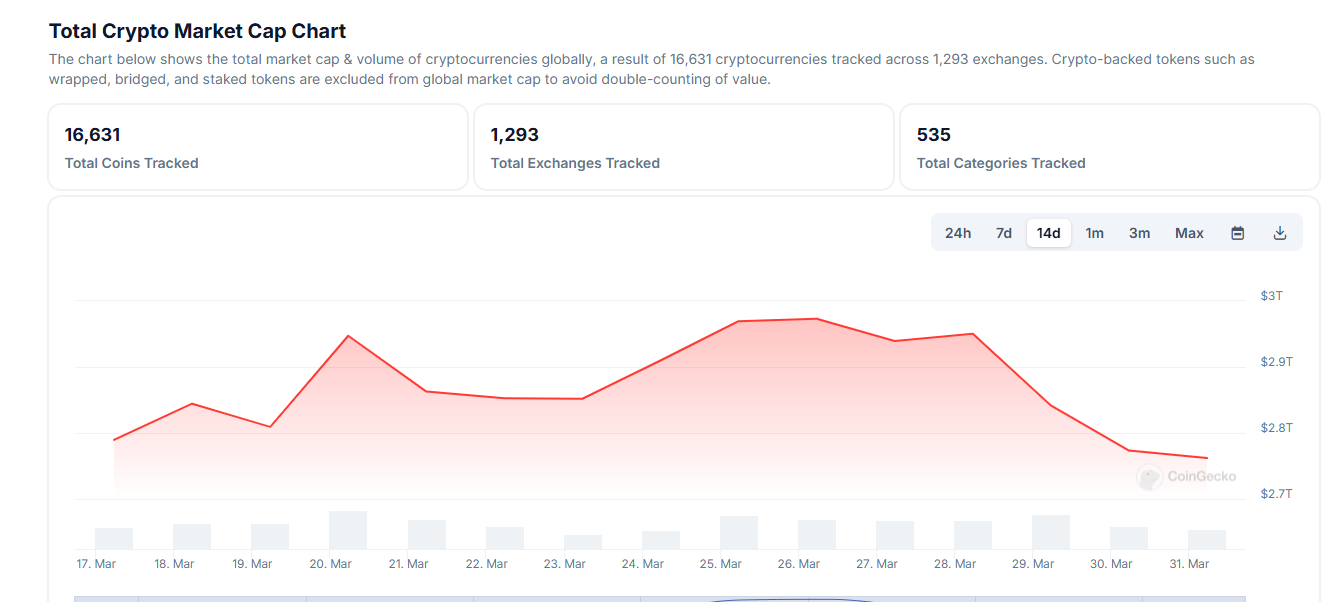

The crypto and global markets remain pressured by the upcoming US President Donald Trump’s tariff plans, set to be unveiled on April 2. The crypto market took a hit last week as its total market capitalization lost more than $130 billion, according to CoinGecko data.

Total crypto market cap chart. Source: CoinGecko

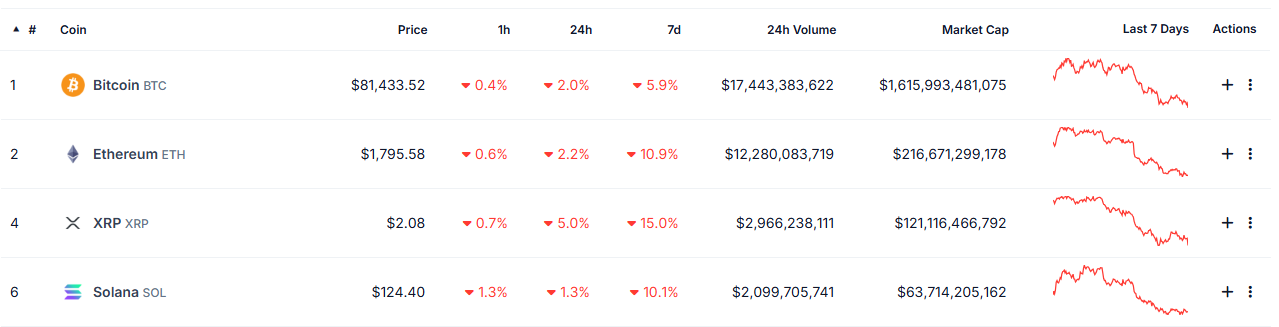

The graph below shows that major cryptocurrencies like BTC, ETH, XRP and SOL fell 5.9%, 10.9%, 15% and 10.1%, respectively, in the last 7 days. At the time of writing on Monday, these cryptocurrencies continue to fall.

Major cryptocurrencies chart. Source: CoinGecko

According to the Kobeissi letter report on Monday, US tariffs will impact $1.5+ trillion of imports by the end of April.

“President Trump has called Wednesday’ Liberation Day’ with 20%+ tariffs coming on up to 25+ countries,” says Kobeissi in its X post.

The report explains that, to be clear, this is the day when President Trump announced “Reciprocal Tariffs.” These will be “NEW tariffs” on top of already existing and announced tariffs.

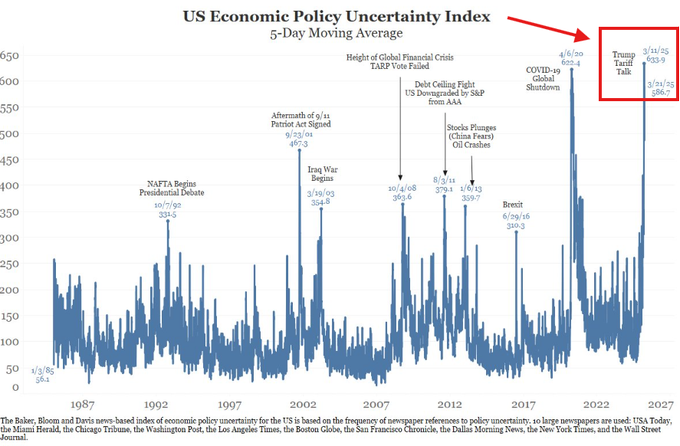

The Economic Policy Uncertainty (EPU) Index chart below measures uncertainty in US economic policy since 1985, with current levels at 600 — 80% higher than during the 2008 financial crisis, signaling extreme market unease. Historical spikes in the metric indicate high uncertainty often precedes significant market volatility, as seen during the 2008 crisis and the 2020 COVID-19 shutdown.

This high uncertainty and volatility market condition often precedes a risk-off sentiment in investors as they migrate toward safer assets like Gold, potentially dampening crypto demand.

Moreover, according to a Wall Street Journal (WSJ) post on Monday, President Trump’s team is considering “broader and higher tariffs” ahead of Wednesday’s reciprocal tariffs deadline.

President Trump reportedly weighs “an across-the-board hike of up to 20%.” Again, April 2 is not just the end of tariff uncertainty, according to a post from the Kobeissi Letter on X.

As uncertainty and volatility hit the global and crypto markets, volatility with potential sell-offs as risk-off sentiment dominates for crypto markets in the short term. However, over the medium to long term, Bitcoin and other cryptos could benefit from increased demand as hedges against inflation and economic uncertainty, especially if inflation rises and traditional markets falter. The historical correlation between EPU shocks and crypto volumes, alongside Bitcoin’s “haven asset” perception, supports this outlook, though short-term risks remain significant due to broader market dynamics.

To gain more insight into how crypto markets would react to these tariff policies, FXStreet interviewed some experts in the crypto markets in this report.