Crypto Today: SHIB, DOGE and PEPE enter $6B gains as BTC aims at $90k

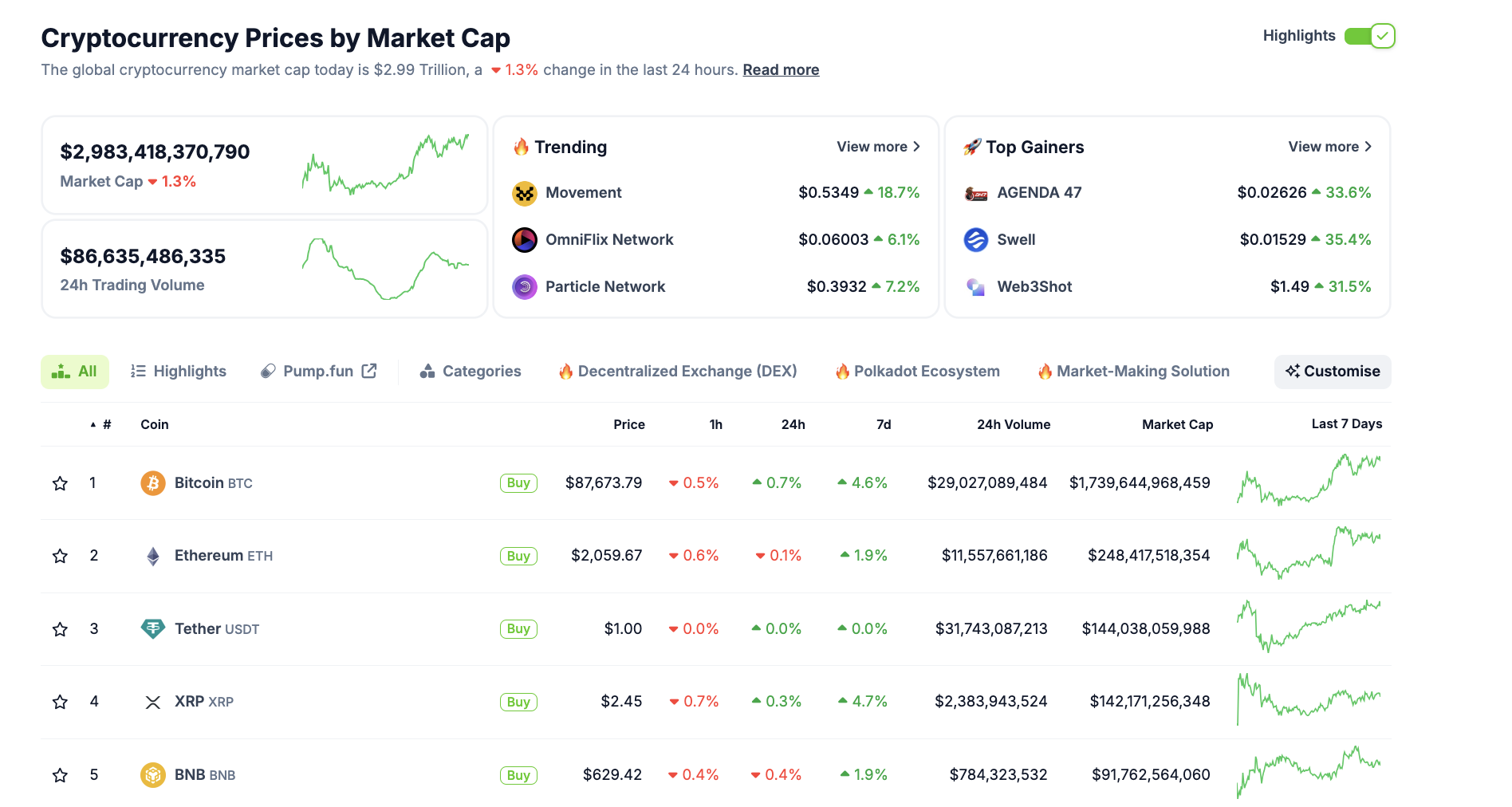

- Cryptocurrency market capitalization dips 1.3% to hit $2.9 trillion on Tuesday, with market indicators showing capital rotation toward memecoins.

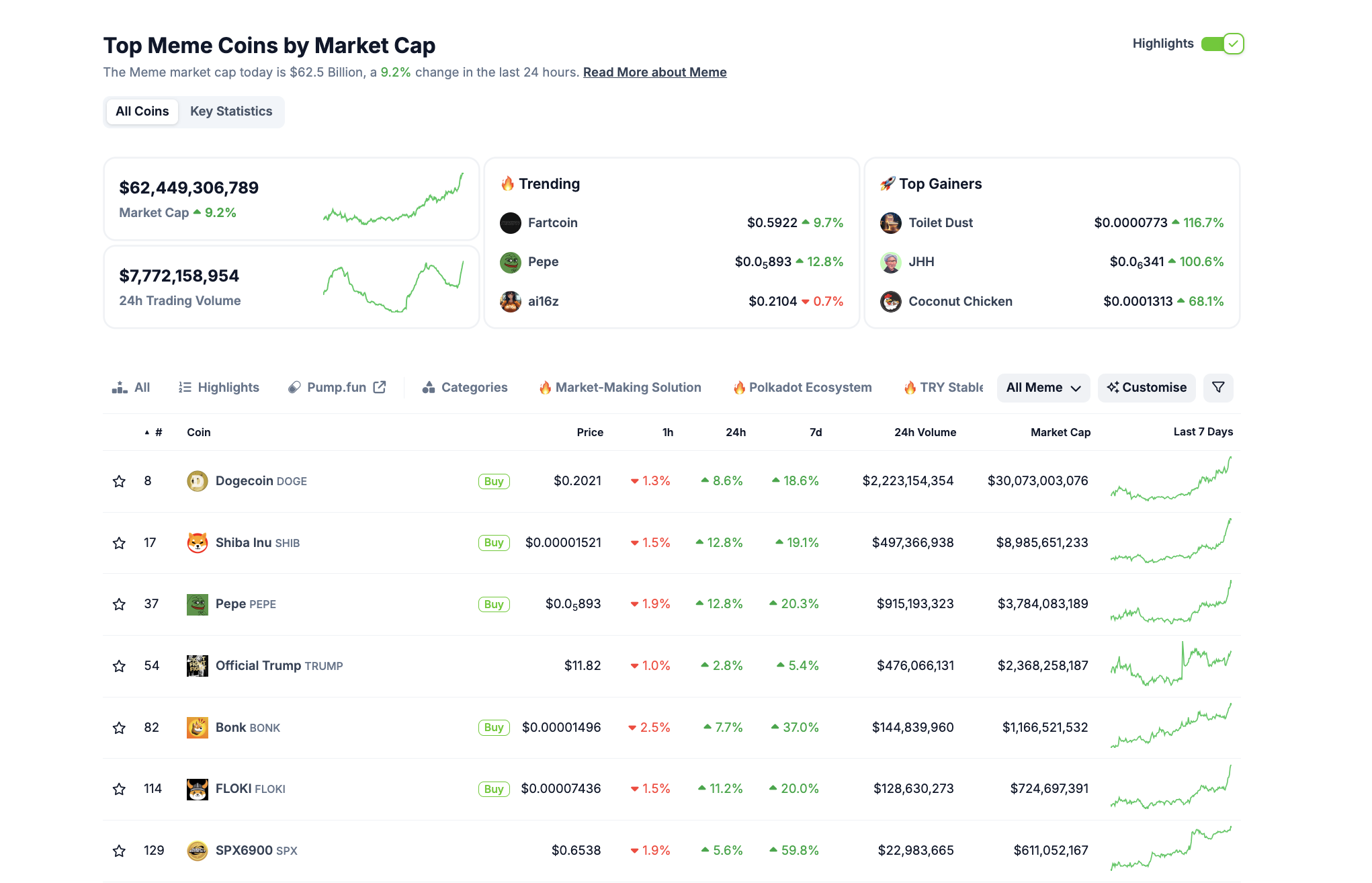

- Memecoin sector valuation has crossed the $62 billion mark, adding 9.2% within the last 24 hours.

- Trump's emphatic support of the official TRUMP token launched at the inauguration has reignited investor confidence in memecoins this week.

Bitcoin market updates:

- Bitcoin’s price tumbled 2% to settle at $86,000 at press time on Wednesday after another unsuccessful attempt at breaching the $90,000 resistance.

- Bitcoin’s dip outpaces the 1.3% decline in the global crypto market, signaling that investors are rotating capital from BTC towards altcoins.

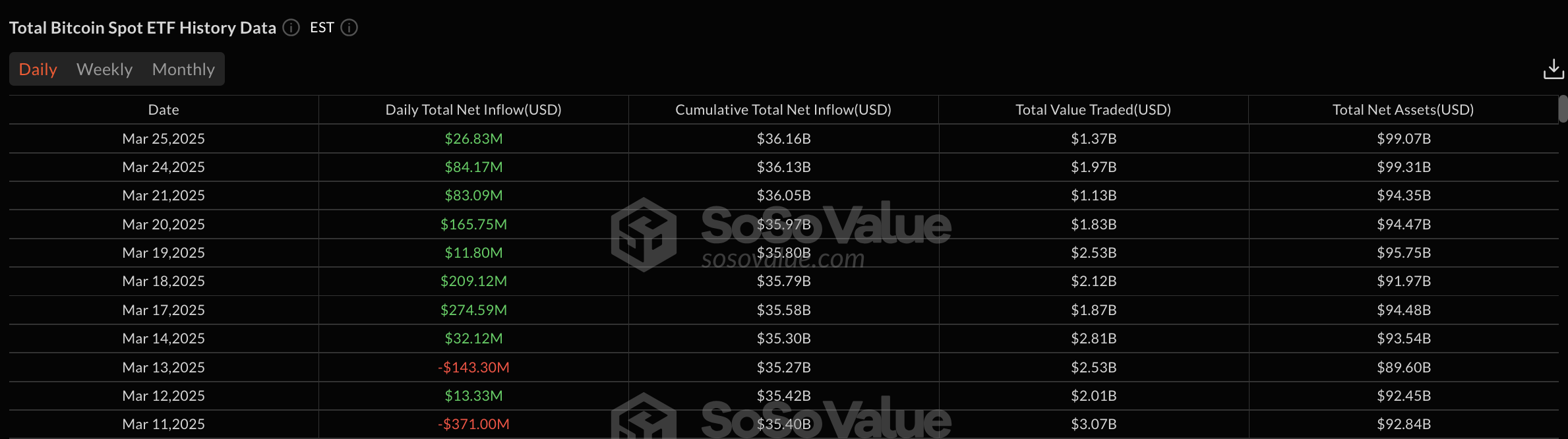

- Bitcoin ETFs continued their buying spree on Tuesday, with another $26.8 million inflow.

Bitcoin ETF Flows | Source: SosoValue

Bitcoin ETF Flows | Source: SosoValue

Since March 14, Bitcoin ETFs have entered eight successive days of inflows, with over aggregate deposits of $887.47 million recorded during that period.

On Tuesday, BlackRock announced the launch of its first Bitcoin exchange-traded product in Europe. At press time, Blackrock’s IBIT BTC ETF net assets stand around $50.8 billion.

Many anticipate that BlackRock’s foray into Europe could increase institutional demand for BTC.

Altcoin market updates: SUI and Polygon in green as traders rotate towards mid-cap assets and memecoins

Riding in positive tailwinds from the recent US Federal Reserve (Fed) rate pause, altcoins received significant inflows at the start of the week. However, as markets crossed the $3 trillion mark, bearish resistance set in. With Bitcoin’s price consolidating below $90,000, the overall market inflow intensity has slowed significantly over the last 24 hours.

Crypto market performance, March 26 | Source: CoinMarketCap

Crypto market performance, March 26 | Source: CoinMarketCap

However, rather than exiting, traders appear to be strategically rotating assets toward sectors with dominant narratives and niche assets with high-growth potential, sidestepping BTC and top-ranked altcoins.

Ripple (XRP), Solana (SOL) and Ethereum (ETH) have all underperformed, each posting losses ranging from 1% to 3% at press time.

Meanwhile, looking down the charts, SUI and Polygon emerged as standout performers among the top 30 ranked assets, posting 3% and 5% gains, respectively.

Chart of the day: Trump support drives memecoin sector valuation above $62 billion

Bitcoin’s price stagnation around the $90,000 mark suggests that investors are shifting their capital toward alternative assets. However, after Donald Trump re-emphasized support for the $TRUMP meme token on Monday, the memecoin received the highest share of capital inflow while top assets consolidated.

Memecoin sector performance | Source: Coingecko

Memecoin sector performance | Source: Coingecko

This trend is evident in the chart above, as the total market capitalization of memecoins rose 9.2%, surpassing the $62.5 billion mark. Among the top-performing memecoins, Dogecoin, Pepe and Shiba Inu are leading the charge:

- Dogecoin (DOGE): Trading at $0.20, Dogecoin has posted an 8.6% gain in the last 24 hours and is up 18.6% over the past week. The latest rally has now pushed DOGE market cap above the $30 billion market.

- Pepe (PEPE): Currently priced at $0.0000089, PEPE has surged by 12.8% in the past 24 hours and 20.3% over the last seven days. Its impressive rally highlights a growing speculative push as traders seek high-growth opportunities.

- Shiba Inu (SHIB): SHIB is trading at $0.000015, recording a 12.8% daily increase and a 19.1% gain over the past week, with a market capitalization nearing $9 billion.

Bitcoin and top layer-1 assets like ETH, XRP and SOL are all in the red on Wednesday.

However, the surge in memecoin prices suggests investors believe the recent Fed rate pause has boosted investors’ confidence, boosting appetite for high-risk assets. It remains to be seen if the positive market sentiment will persist or if Bitcoin's lack of motion will trigger a market-wide correction in the days ahead.

Crypto news updates:

-

SEC closes investigation into Immutable with no charges

The US Securities and Exchange Commission (SEC) has officially ended its investigation into Australian crypto firm Immutable without filing any charges.

The company, which had previously received a Wells notice regarding potential securities law violations, celebrated the outcome as a significant win for digital ownership in the gaming sector.

This decision follows a broader pattern of the SEC dropping cases against major crypto entities in recent months.

Robinhood, Uniswap, and Ripple have all seen regulatory scrutiny ease since the Trump-appointed SEC leadership took over.

The shift comes as the administration moves toward clearer crypto regulations, marking a departure from the enforcement-heavy approach seen under former SEC Chair Gary Gensler.

-

Fidelity to introduce US Dollar-pegged stablecoin and Ethereum-based fund share class

Fidelity Investments is set to launch a US Dollar-pegged stablecoin and an Ethereum-based share class for its US Dollar money market fund.

The stablecoin will be issued through Fidelity Digital Assets, aligning with the company's ongoing expansion into blockchain-based financial products.

Meanwhile, the Ethereum-based ‘OnChain’ share class is designed to enhance transaction tracking for the Fidelity Treasury Digital Fund.

These initiatives come as part of Fidelity’s broader strategy to adapt to a regulatory environment that is becoming more accommodating to crypto assets.

The move positions Fidelity among a growing number of major financial institutions integrating blockchain technology into traditional finance.