Bitcoin Price Forecast: BTC stabilizes below key resistance, risk-off sentiment persists

- Bitcoin faces resistance around its 200-day EMA at $85,500; a firm close above indicates recovery on the cards.

- US spot Bitcoin ETF shows the second straight day of inflows so far this week.

- A K33 report highlights that Bitcoin has trended lower, with heightened correlations reflecting a broader risk-off sentiment.

Bitcoin (BTC) trades around $83,300 at the time of writing on Wednesday after facing resistance around its 200-day Exponential Moving Average (EMA) at $85,500 since last week, with a break above this level suggesting a potential recovery. The US spot Bitcoin Exchange Traded Funds (ETFs) have recorded inflows for the second consecutive day this week, signaling a reduction in sell-side pressure. Meanwhile, a K33 report highlights that Bitcoin has trended lower, with increased correlations indicating a broader risk-off sentiment in the market.

Bitcoin could expect volatility around the FOMC meeting

A K33 report on Tuesday highlights that Bitcoin has trended lower, with heightened correlations reflecting a broader risk-off sentiment. Traders are reducing exposure amid uncertainty, and the upcoming Federal Open Market Committee (FOMC) meeting is unlikely to meaningfully shift this dynamic as markets focus on fiscal policy and Scott Bessent’s 10-year yield strategy.

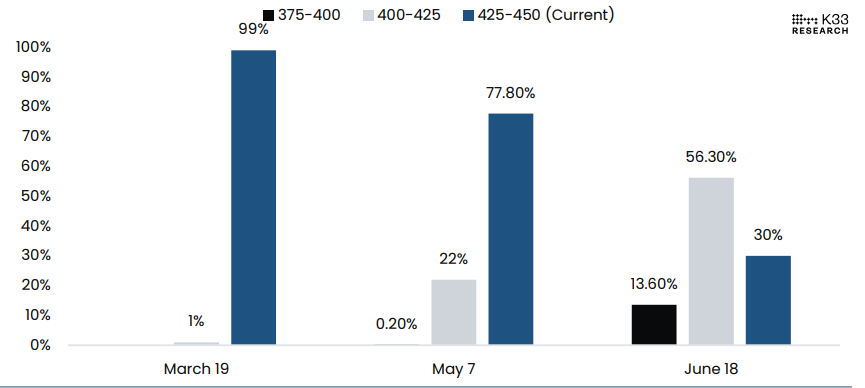

The report explains that for Wednesday’s FOMC, the market is fully aligned on no changes to the interest rate despite easing inflation pressures and a slight increase in the US unemployment rate. However, the market is pricing in a higher likelihood of cuts in the coming FOMC meetings, with market-implied probabilities suggesting a 22% chance of a 25 basis point (bps) cut in May, rising to 56.3% by June.

These odds point toward considerable volatility as the market absorbs the dot plot and forward guidance from Federal Reserve Chair Jerome Powell during the FOMC press conference. While FOMC always introduces considerable volatility, US fiscal policies have been the key market movers lately.

The report further explains that the tariffs and their back-and-forth have generated significant downside volatility recently, heightening worries of an economic slowdown. Reciprocal tariffs set for April 2 will likely spark heightened volatility as nations adjust and respond to evolving trade measures. Concerns about an economic slowdown have contributed to lowering the 10-year Treasury yield, which has been an outspoken target for US Treasury Secretary Scott Bessent, aiming to reduce the 6.7% US deficit to GDP.

Target rate probabilities for upcoming FOMC meetings chart. Source: K33 Research

“The current fiscal measures dampen the economy in the short term, with Bessent viewing these measures as a detox from a market hooked on government spending. Amid this detox, markets have slipped. Whether or not reduced corporate taxes and deregulation will ease this detox remains a hotly debated topic, but investors seem to shy away from risk for now,” says a K33 analyst.

In an exclusive interview, Tracy Jin, COO of the crypto exchange MEXC, told FXStreet, “Bitcoin is expected to continue trading within the $81,000–$86,000 range.”

Jin continued the new target for this week, which is set at $91,000–$92,000. A failure to break through $87,000-88,000 quickly could put pressure on buyers. Whether this level can be surpassed will depend on upcoming events and how market participants react.

“Major geopolitical events and decisions related to ongoing conflicts may have a stronger impact on Bitcoin’s price than developments in the US market. Gold has recently hit an all-time high, reinforcing its status as a safe-haven asset. As a result, any potential geopolitical turmoil may push Bitcoin’s price down into the $56,000–$72,000 range," Jin told FXStreet.

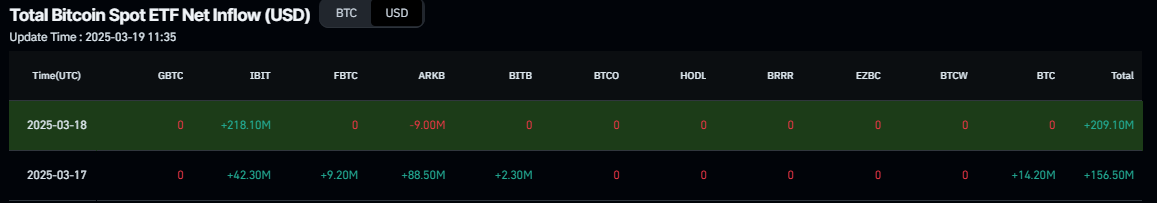

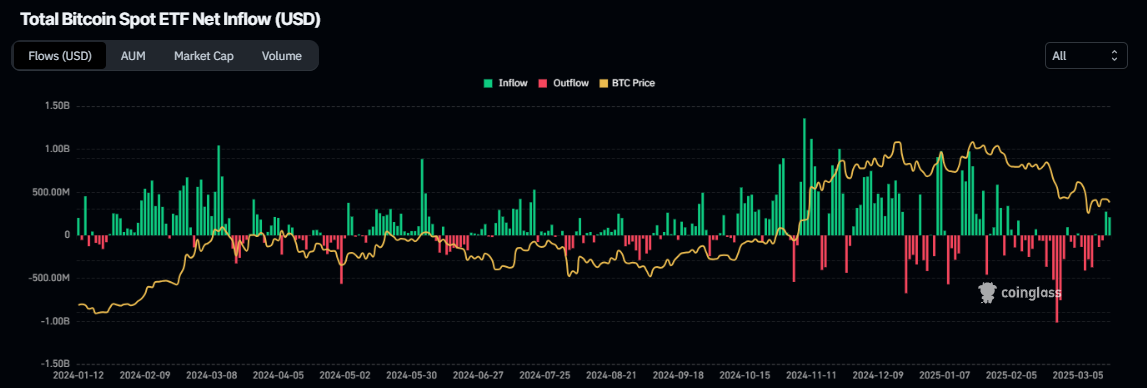

Bitcoin institutional demand shows a slight improvement

Bitcoin institutional investors have shown slight signs of improvement this week. According to Coinglass data, the Bitcoin spot ETF recorded a second straight day of net inflow of $209.10 million on Tuesday, after a net inflow of $156.50 million the previous day. Bitcoin's price could see further recovery if this inflow continues and intensifies, indicating a reduction in sell-side pressure.

Total Bitcoin spot ETF net inflow chart. Source: Coinglass

However, despite the mild rise in institutional demand, Ki Young Ju, founder of the CryptoQuant on-chain and market data analytics platform, posted on his social media X that the “Bitcoin bull cycle is over, expecting 6–12 months of bearish or sideways price action.”

Ju further explains that every on-chain metric signals a bearish market, and with fresh liquidity drying up, new whales are selling Bitcoin at lower prices.

Bitcoin Price Forecast: BTC could rally if it closes above its 200-day EMA

Bitcoin price has faced resistance around the 200-day Exponential Moving Average (EMA) at $85,502 since Friday and trades below it. This level coincides with the daily resistance level at $85,000, making it a key resistance zone. At the time of writing on Wednesday, BTC trades around $83,300.

The Relative Strength Index (RSI) indicator suggests a lack of momentum on the daily chart, consolidating below its neutral level of 50. However, the lower low in the Bitcoin price formed on March 11 does not reflect the RSI higher high for the same period. This development is termed a bullish divergence, often leading to a trend reversal or short-term rally.

If bullish divergence plays a part and BTC closes above its 200-day EMA at $85,502, it could extend the recovery to $90,000.

BTC/USDT daily chart

However, if BTC corrects and closes below $78,258 (February 28 low), it could extend the decline to retest its next support level at $73,072.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.