Bitcoin News: Crypto investigator calls whale shorting BTC on Hyperliquid a cyber criminal

- On-chain investigator ZachXBT has identified the whale who opened short Bitcoin with 40x leverage on Hyperliquid.

- The trader closed a $332 million short position, earning over $9 million despite coordinated efforts to force liquidation.

- Bitcoin price plunged 3% on Tuesday, hitting new lows for the week circa $81,160.

Bitcoin price slumped 3% Tuesday as an on-chain investigator identified a whale who shorted BTC with 40x leverage, profiting millions despite liquidation attempts.

Bitcoin short whale identified as cybercriminal using stolen funds

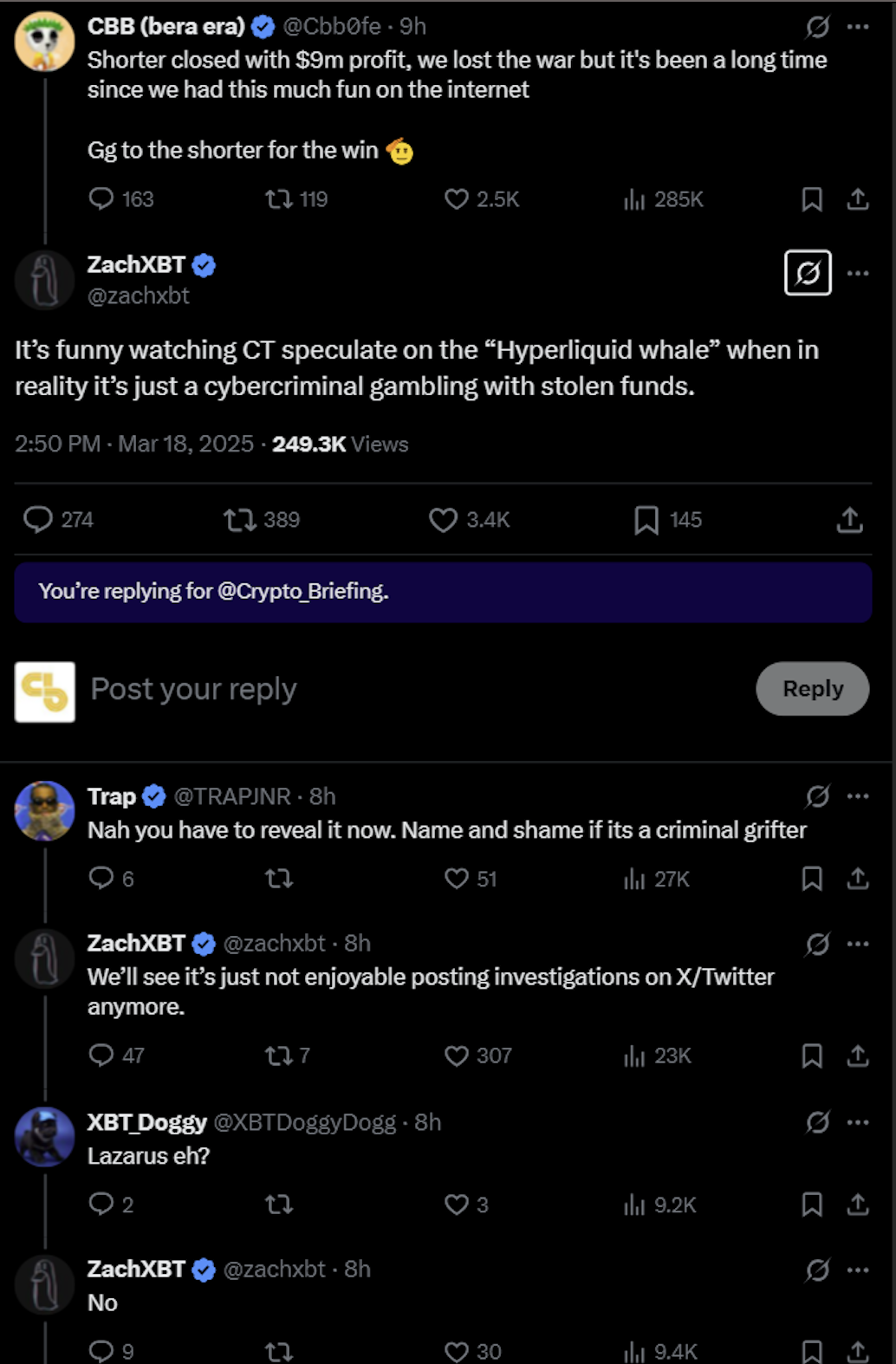

On-chain investigator ZachXBT claimed the crypto whale that executed a high-leverage short trade on Bitcoin is a cybercriminal that used “stolen funds.”

The trader closed a 40x leveraged short position, securing over $9 million in profit despite efforts to force liquidation.

Data from Lookonchain shows the whale opened a 3,940 BTC short position at $84,040 on Saturday, valued at $332 million, with a liquidation price of $85,300.

Pseudonymous trader CBB led an effort to push Bitcoin's price beyond this threshold, briefly reaching $84,690. The whale countered by adding $5 million in USDC to increase the margin, avoiding liquidation.

Zach ZBT exposes Hyperliquid Bitcoin whale as Cybercriminal | Source: X.com

Despite continued pressure, the whale expanded the short position and exited on Tuesday with a multi-million-dollar gain.

While ZachXBT confirmed the trader’s cybercriminal background, no further identity details were disclosed.

The investigator clarified that the individual is not linked to North Korea’s Lazarus Group, known for high-profile crypto hacks, including the recent Bybit exchange breach.

Bitcoin price forecast: $80,000 support wobbles ahead of US Fed rate decision

Bitcoin price is trading at $81,865 after a 2.55% decline on Tuesday.

Technical indicators show that BTC stands the risk of losing the $80,000 support as selling pressure mounts ahead of the United States (US) Federal Reserve (Fed) rate decision slated for Wednesday.

As seen below, BTC is trapped within the Keltner Channel, with upper resistance at $93,756 and lower support at $77,139.

The midline at $85,447 is acting as resistance, keeping BTC in a downtrend.

Bearish sentiment is further emphasized by BTC’s failure to reclaim the $85,000 zone after several attempts this week.

If sellers push BTC below $80,000, a breakdown could trigger further losses towards $77,000 should selling pressure intensify after the Fed’s decision.

Bitcoin price forecast | BTCUSDT

However, a bullish scenario emerges if BTC holds above $80,000 and reclaims the midline at $85,447.

This would invalidate near-term bearish pressure and open the door for a potential breakout toward $90,000.

The Accumulation/Distribution Line (ADL) remains steady at 1,593, indicating neutral capital inflows.

A surge in ADL alongside price recovery could confirm renewed bullish momentum.

Until then, BTC remains vulnerable to macroeconomic uncertainty, with the next major move hinging on the imminent Fed rate decision.