XRP traders withdraw $130M from Binance ahead of Ripple CEO’s White House Summit appearance

- Ripple (XRP) price stabilized above $2.52 on Friday, posting a 23% weekly gain.

- XRP reclaimed the $2.50 level after Ripple’s CEO Brad Garlinghouse's attendance at the White House Summit was confirmed.

- XRP deposits on Binance have declined by $100 million since Trump announced a crypto strategic reserve on Sunday.

Ripple (XRP) price stabilized above $2.4 on Friday, posting 23% gains over the week. Rapid exchange outflows since the crypto strategic reserve announcements could trigger another breakout phase.

XRP price holds firm above $2.40 as White House Summit fuels speculation

XRP has shown resilience against broader market volatility, defying the corrective downturn seen in other mid-cap assets like Sui (SUI) and Chainlink (LINK).

Investors appear to be positioning ahead of the White House Summit, where United States (US) President Donald Trump is expected to meet with cryptocurrency executives and industry stakeholders to discuss regulatory frameworks and the allocation of digital asset reserves.

Ripple (XRP) Price Action

Ripple (XRP) Price Action

At press time on Friday, XRP continues to hold above the $2.40 support level, reinforcing its bullish trajectory and posting a 23% gain over the past week.

The resilient price action on Friday can be linked to investors' reaction to reports confirming Ripple CEO Brad Garlinghouse’s attendance at the high-profile White House summit.

At the event, Trump is set to meet crypto founders and key stakeholders to discuss regulation frameworks and crypto reserve allocation protocols.

With Ripple CEO’s attendance confirmed, traders are anticipating positive announcements from the event could spark another rally.

XRP outflows from Binance suggest long-term accumulation ahead of policy updates

Aside from the resilient price action, on-chain data trends indicate that XRP holders are actively withdrawing assets from exchanges in what appears to be a shift toward long-term storage.

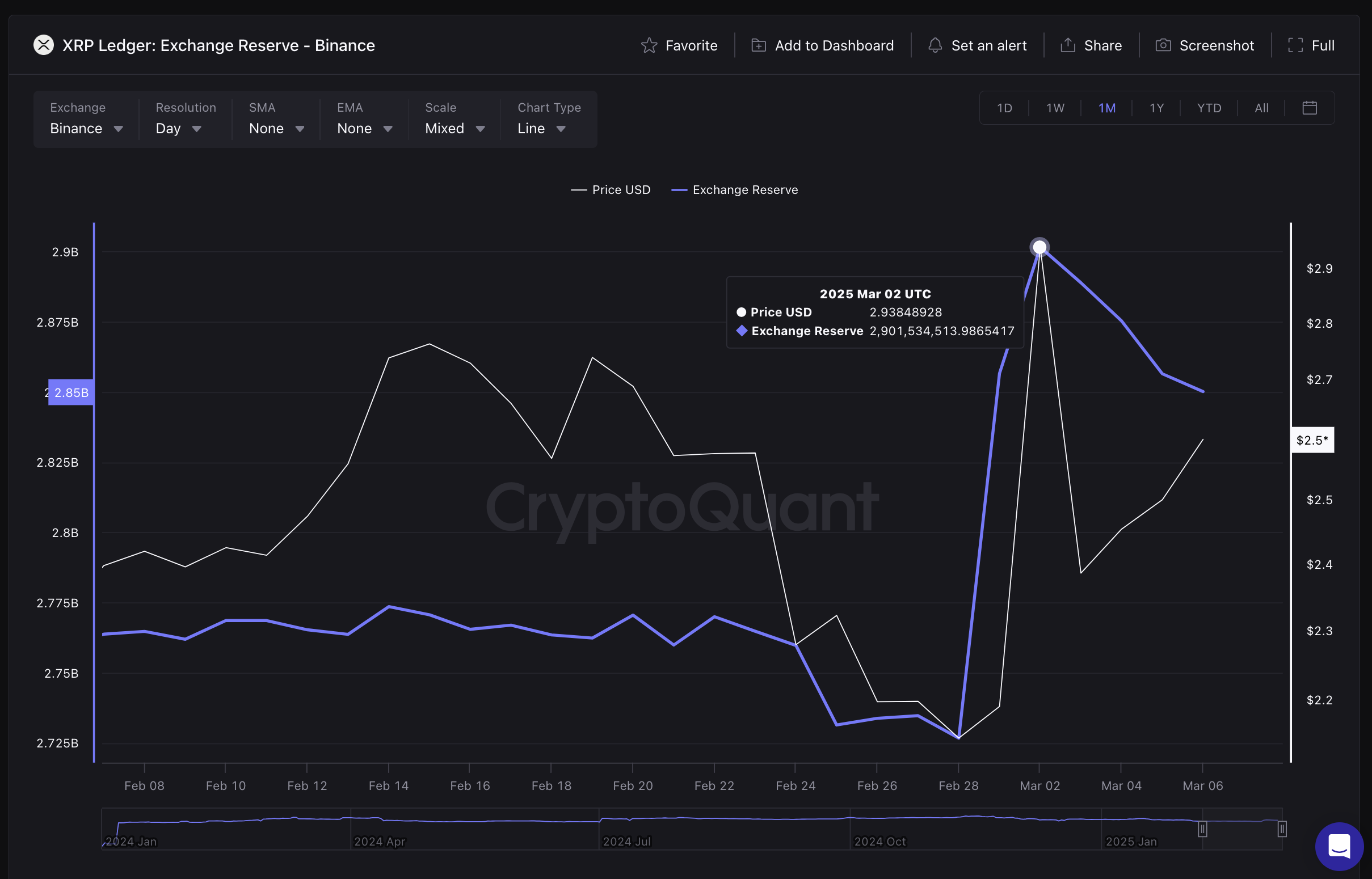

CryptoQuant’s exchange reserve metrics show that Binance-hosted XRP wallets held 2.9 billion tokens as of March 2.

By Friday, reserves had declined to 2.85 billion, reflecting an outflow of 50 million XRP—equivalent to roughly $130 million at current market prices.

Ripple (XRP) Exchange Reserves on Binance, March 7 | Source: CryptoQuant

Large-scale withdrawals from centralized exchanges are often interpreted as bullish signals, suggesting that investors are opting to hold assets in cold storage rather than trade them on the open market.

This pattern aligns with broader industry speculation that institutional investors may be quietly accumulating XRP and other coins in the crypto strategic reserve to front-run potential upside from anticipated large-scale buys by the US treasury.

Market participants are also watching for potential short-term volatility stemming from Friday’s summit. Some investors may be positioning for profit opportunities depending on the policy direction signaled by top headlines from the White House Summit.

The combined impact of reduced exchange liquidity and heightened speculative interest could set the stage for a breakout beyond the $2.50 level in the coming days.

XRP price forecast: MACD hints at bullish momentum but $2.40 support must hold

XRP price remains volatile but leans bullish after reclaiming $2.60 earlier in the session.

The recent price action reveals a 19.33% surge over two days underpinned by a strong accumulation trend, as reflected in the rising Accumulation/Distribution (A/D) indicator, which currently stands at 74.22 billion.

This suggests that capital inflows remain strong, reinforcing XRP’s ability to maintain its recent breakout.

However, with price retracing to $2.47, the bulls must defend the critical $2.40 support to sustain the rally.

XRP price forecast

The MACD indicator has flipped positive, with the MACD line at 0.0238 now crossing above the signal line at -0.0347.

This bullish crossover typically signals an increase in momentum, suggesting that XRP could extend its gains toward the psychological $3.00 level if buyers maintain control.

Additionally, the histogram has turned green, confirming strengthening upside momentum.

However, failure to sustain this crossover could trigger a bearish divergence, leading to renewed selling pressure.

Despite strong accumulation, XRP faces risks of a short-term pullback.

The recent 5.84% decline highlights traders taking profit at higher levels, and with increased leverage in the market, volatility could accelerate in either direction.

A decisive break below $2.40 may expose XRP to deeper losses toward $2.20, while a recovery above $2.60 would reaffirm bullish control.