Crypto Fear and Greed Index hits three-year low as sell-off from recent buyers weighs on Bitcoin

- The Crypto Fear and Greed Index fell to its lowest level since 2022, signaling extreme fear in the market.

- Bitcoin's price dived lower following further tariff threats from President Trump on China and Europe.

- Short-term Bitcoin holders have realized over $2 billion in losses within the past three days.

Bitcoin (BTC) experienced significant selling pressure on Thursday, reflected by the Crypto Fear and Greed Index reaching its lowest level since June 2022. Glassnode noted that most of this selling pressure comes from short-term holders, who have realized $2.16 billion in losses over the past three days.

Bitcoin dips as investor sentiment nears extreme fear

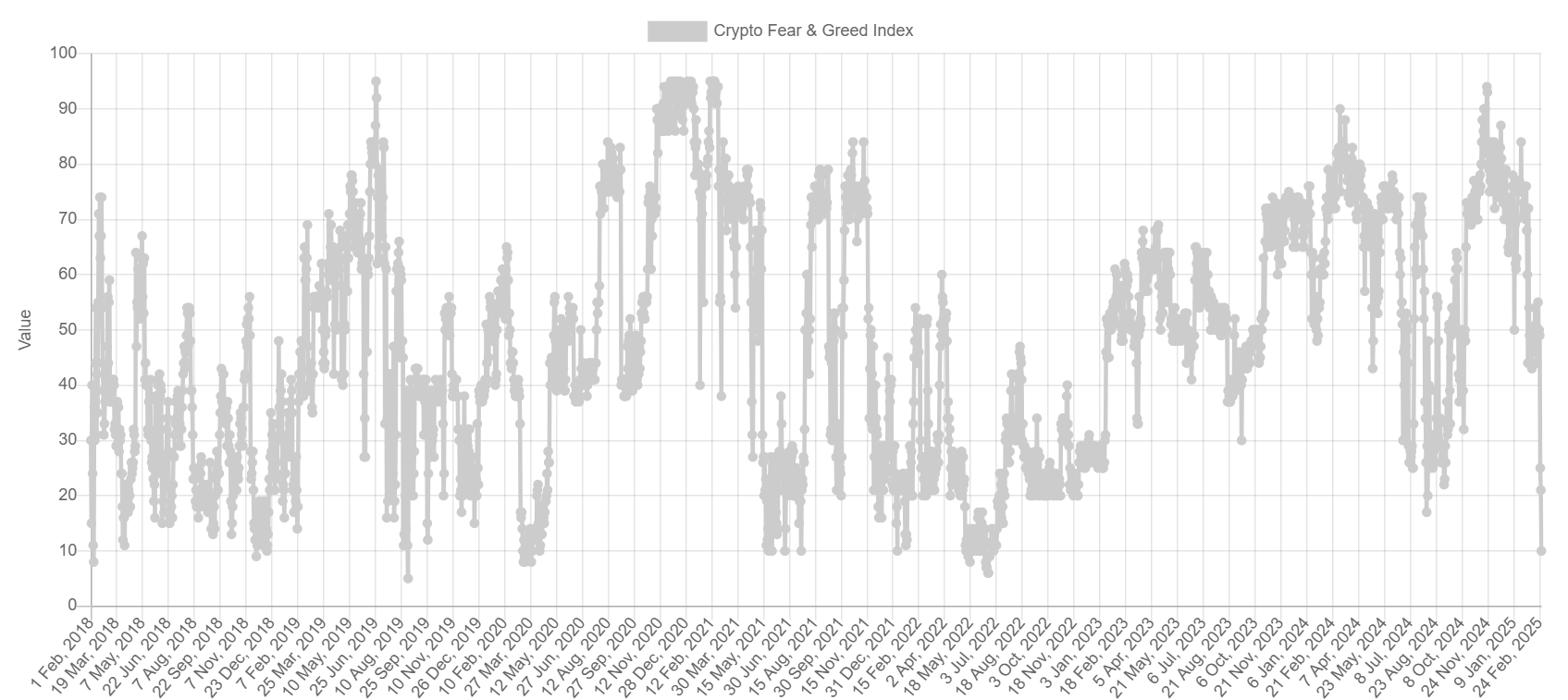

The Crypto Fear and Greed Index — a metric that measures the overall sentiment of the cryptocurrency market — dropped to nearly a three-year low on Thursday.

The index hit a score of 10, indicating a shift in investor sentiment toward extreme fear following recent tensions over US President Donald Trump's tariff plans and the recent hack on crypto exchange Bybit.

Crypto Fear and Greed Index. Source: Alternative

President Trump announced plans to impose an additional 10% tariffs on imports from China on top of existing ones, alongside a 25% tariff on Canada and Mexico beginning on March 4. Trump also plans to slap a 25% tariff on imports from Europe.

The combination of Trump's tariffs and a $1.44 billion hack on crypto exchange Bybit has seen the crypto market sustain massive selling pressure, with Bitcoin plunging toward $83,000.

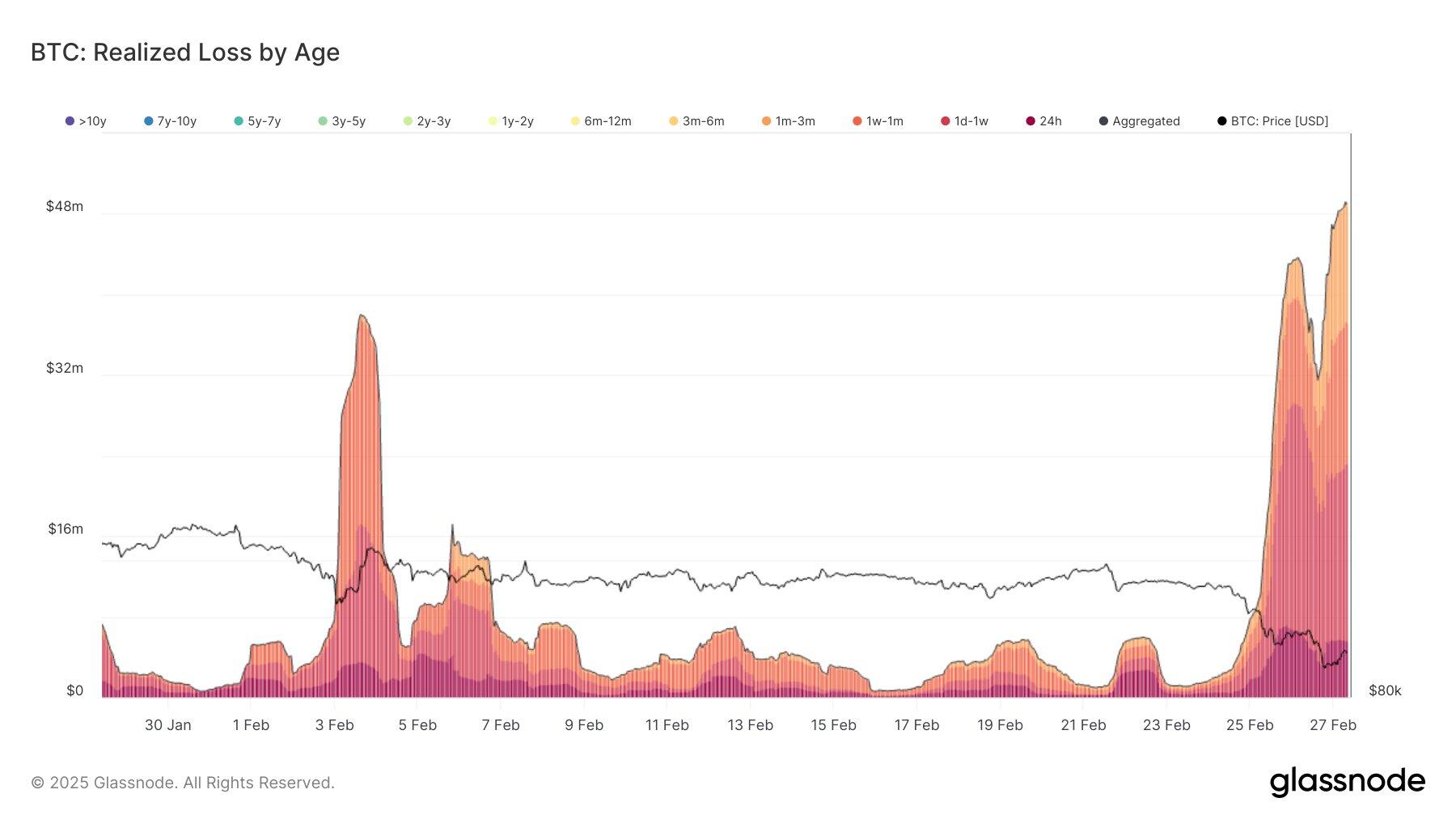

Most of the recent Bitcoin sell-off stems from the short-term holder (STH) cohort, which has realized losses worth $2.16 billion in the past three days, according to a Thursday X post by crypto analytics platform Glassnode.

The largest realized losses came from investors who purchased Bitcoin within the past week. This group of holders realized $927 million in losses, making up 42.85% of the young cohort losses.

Likewise, holders between a week and a month realized losses worth $678 million. Those between a month and a year witnessed losses of $257 million, while those who bought within the 24-hour range realized losses of $322 million.

BTC Realized Loss by Age. Source: Glassnode

The increased realized losses reflect growing market stress, as decreased market confidence is pushing many recent buyers to exit their positions.

Glassnode further highlights the change in short-term holder behavior, measured by the Short-Term Holder Spent Output Profit Ratio (STH-SOPR).

"Historically, deep SOPR contractions have led to at least temporary market stabilization as weaker hands exit," wrote Glassnode analysts in a Wednesday report. "However, under current macroeconomic conditions, the risk remains that the price decline could extend further if no strong demand catalyst emerges."

The STH-SOPR has dropped by -0.04 below its quarterly median, a sharp decline that surpasses the typical standard deviation threshold of -0.01.

Such a drop indicates that more short-term holders are selling their Bitcoin at a loss.

If Bitcoin continues showing a strong correlation to macroenomic conditions, its price could face more downward pressure until signs of a global trade war subsidize.