Gold price rises as US yields drop on stagflation fears

- Gold is up 0.26% as real yields slide and inflation expectations rise on trade policy worries.

- US Consumer Confidence hits 4-year low, boosting stagflation narrative and demand for safe-haven assets.

- Fed officials note reaccelerating goods inflation, adding to market doubts about near-term rate cuts.

Gold price advances on Tuesday as the US Dollar (USD) remains on the back foot and amid falling US real yields, which typically correlate inversely to bullion prices. An unexpected rise in inflation expectations, spurred by US trade policies, boosted demand for the yellow metal, which is gaining 0.26%, trading at $3,018.

The market mood is mixed, with US equity indices split between gainers and losers. US data revealed that Consumer Confidence fell to its lowest level in more than four years as households fear a future recession amid elevated inflation readings, according to the Conference Board (CB). This paints a stagflationary outlook.

Therefore, the yellow metal edged higher as recent data paints a stagflationary economic outlook.

Elsewhere, some Federal Reserve Fed) officials crossed the wires. Governor Adriana Kugler stated that goods inflation has risen, noting that some subcategories have shown signs of reaccelerating. Last but not least, New York Fed President John Williams remarked that both companies and households are facing increased uncertainty about the economic outlook, reflecting growing concerns about future conditions.

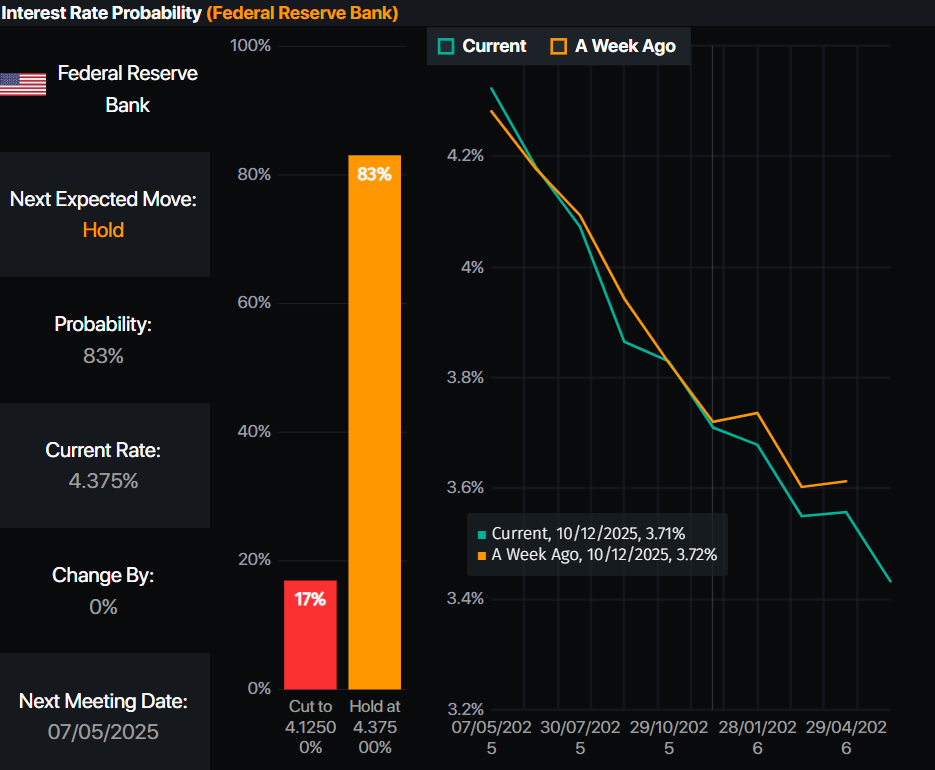

The money market has priced in 64.5 basis points of Fed easing in 2025, according to Prime Market Terminal interest rate probabilities data.

Source: Prime Market Terminal

Daily digest market movers: Gold price underpinned by high inflation expectations

- The US 10-year T-note yield is down three basis points (bps) at 4.308%. US real yields drop three bps to 1.956% according to US 10-year Treasury Inflation-Protected Securities (TIPS) yields.

- The US Dollar Index (DXY), which tracks the performance of the Greenback against a basket of six currencies, drops 0.15% to 104.15.

- The CB Consumer Confidence in March fell from 100.1 to 92.9, missing estimates of 94.

- According to the CB, write-in responses to the survey showed “worries about the impact of trade policies and tariffs in particular are on the rise.”

- On Monday, Atlanta Fed President Raphael Bostic stated that he supports only one rate cut this year and doesn’t expect inflation to return to target until around 2027.

XAU/USD technical outlook: Gold price advances past $3,010

The uptrend in Gold remains in play, though buyers are lacking the conviction to achieve a daily close above the current week’s high of $3,036, which could exacerbate a test of the record high price at $3,057. A breach of the latter will pave the way for testing $3,100.

The Relative Strength Index (RSI) is bullish, with momentum backing buyers. Therefore, a further upside in Bullion prices is seen.

On the other hand, if XAU/USD drops below $3,000, this will expose the February 24 swing high at $2,956, followed by the $2,900 mark and the 50-day Simple Moving Average (SMA) at $2,874.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.