Gold price steadies as markets weigh tariff uncertainty, Fed outlook

- XAU/USD holds firm as speculation grows over Trump’s potential tariff rollback.

- Gold fluctuates around $2,910 amid mixed economic signals and policy uncertainty.

- US ADP jobs data disappoints, while ISM Services PMI shows inflation risks persist.

- Traders eye US Nonfarm Payrolls data Friday for Fed rate-cut clues.

Gold price remains firm on Wednesday amid speculation that the President of the United States (US), Donald Trump, could roll back some tariffs, at least duties on automobiles linked to the USMCA free trade agreement. Nevertheless, uncertainty remains, and XAU/USD trades at $2,919, virtually unchanged.

Bullion prices had been seesawing around the $2,910 mark during the North American session as the news flow continued. The Federal Reserve (Fed) revealed the Beige Book in anticipation of the upcoming monetary policy, stating that overall economic activity rose, yet prices are higher amid Trump trade policies.

Data-wise, ADP revealed that private hiring in February slowed sharply compared to January’s figures. Meanwhile, according to February's latest ISM Services PMI, businesses continued to expand healthily. Despite this, fears that inflation could reaccelerate remained, as Prices Paid, a sub-component of the PMI, jumped above the 60 level, hinting that producers are paying higher prices, which could stoke a second round of inflation.

Meanwhile, recently revealed US data sparked recessionary fears. The Atlanta Fed GDPNow Model projects the Gross Domestic Product (GDP) for Q1 2025 at -2.8%, down from 1.6% estimated on Monday.

Regarding geopolitics, an aide of Ukraine President Zelensky discussed steps to achieve peace with the US National Security Advisor as Ukraine and the US agreed on a meeting soon.

This could push Gold prices lower, alongside higher US Treasury bond yields. Traders will be eyeing Friday's release of February’s Nonfarm Payrolls figures, with analysts projecting 160K jobs added to the workforce.

Daily digest market movers: Gold price consolidates amid mixed US data

- The US 10-year Treasury note climbs four basis points (bps) to 4.28%.

- US real yields, as measured by the US 10-year Treasury Inflation-Protected Securities (TIPS) yield, are rising four and a half bps up to 1.935%.

- The ADP National Employment Change report showed that US private sector hiring increased by 77K in February, significantly missing the 140K forecast and falling well below January’s strong 186K gain.

- Meanwhile, the ISM Services PMI expanded to 53.5 in February, exceeding expectations of 52.6 and improving from January’s 52.8, signaling continued growth in the services sector.

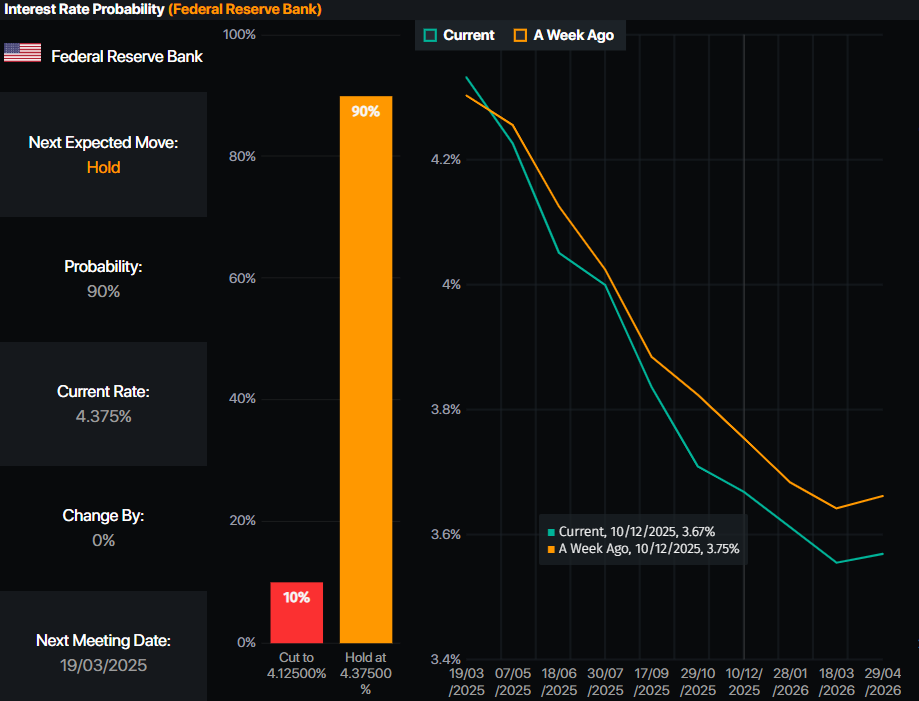

- Money market traders had priced in 71.5 basis points of easing in 2025, down from Tuesday’s 81 bps, via data from the Prime Market Terminal.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price holds firm above $2,900

Gold prices stalled on Wednesday after registering two consecutive bullish days. Nevertheless, momentum is shifted to the upside, with the Relative Strength Index (RSI) trending up in bullish territory. That said, Bullion’s path of least resistance is a continuation of the uptrend.

XAU/USD next resistance would be $2,950, followed by the record high at $2,954. A breach of the latter can expose the $3,000 mark. On the other hand, a daily close below $2,900, could put the uptrend at risk and open the door for a “healthy” pullback.

That said, Gold’s first support would be the February 28 low of $2,832, followed by the $2,800 figure.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.