Ripple Price Forecast: How SEC-Ripple case and ETF prospects could shape XRP’s future

XRP bulls are not ready to give up control of the $2.00 support line, suggesting consolidation before another leg up.

The SEC-Ripple legal battle is approaching its ultimate resolution, with the approval of a joint motion to pause appeals in the case.

The crypto community anticipates Paul Atkins' swearing-in as SEC Chair and his prompt decisions on XRP ETF applications.

XRP faces growing downside risks below $2, with the RSI indicator stuck below the center line and eyeing the oversold region.

Ripple (XRP) consolidated above the pivotal $2.00 level while trading at $2.05 at the time of writing on Friday, reflecting neutral sentiment across the crypto market. Investors have tempered expectations amid the tariff war waged by United States (US) President Donald Trump, which has significantly morphed into a larger trade war between the US and China. The approval of a joint motion filed by Ripple and the Securities and Exchange Commission (SEC) to pause appeals in the longstanding legal battle on Wednesday hardly moved XRP price, underscoring the negative impact of the changing macroeconomic environment on cryptocurrencies.

Bitcoin (BTC) sustained support at $84,000, but its upside remains capped under $85,000 at the time of writing. Altcoins, including Ethereum (ETH), BNB, and Solana (SOL), show signs of recovery, although they have little conviction to move higher. If this mundane price action continues, more investors could turn to meme coins, hoping for larger movements, as reported by FXStreet.

XRP's bullish outlook hinges on SEC case resolution and ETF approvals

A US appellate court on Wednesday granted a joint request by Ripple and the SEC to hold appeals in the lawsuit in abeyance, paving the way for a 60-day temporary hiatus. This will allow the two parties to conclude settlement negotiations, which Ripple's CEO Brad Garlinghouse confirmed recently were at an advanced stage, awaiting the Commission's vote.

Ripple could pay a significantly lower fine of $50 million compared to the $125 million penalty imposed by US District Court Judge Analisa Torres in August 2024.

President Trump's nominee, Paul Atkins, is set to take over the agency's leadership following the Senate approval on April 9. Atkins has promised to prioritize the creation of a clear regulatory framework for digital assets, fuelling expectations of a faster resolution in the SEC-Ripple case and possibly the licensing of the first XRP exchange-traded funds (ETFs) in the US. Still, the crypto community must be patient for his swearing-in, which could take place in the coming days.

Multiple fund managers have applied to operate XRP ETFs, with some deadlines approaching in May. Experts at Kaiko Research say that XRP ETFs have a higher approval chance than other altcoins like Solana (SOL) and Cardano (ADA).

"A slew of asset managers have filed for crypto-related ETFs and with deadlines rapidly approaching Atkins could set his stall out early—and change the narrative entirely from the previous regime at the SEC," Kaiko Research wrote in a recent report.

The resolution of the SEC-Ripple lawsuit and the Commission's decision on XRP ETFs will significantly affect the direction the XRP price may take in the coming weeks and months. For now, traders may want to temper expectations, reduce exposure and wait for a confirmed move on either side of the $2.00 level.

XRP price in dilemma, hangs at the edge of a cliff

XRP is firmly supported at $2.00 and trading at $2.05 at the time of writing. In addition to this pivotal level, there are two other key levels: the 200-day Exponential Moving Average (EMA) at $1.96 and the confluence resistance formed by the 50-day and 100-day EMAs around $2.22.

XRP/USDT daily chart

A break above the upper range limit would reinforce the bullish outlook and encourage more traders to buy XRP. The cross-border money remittance token must push past the descending trendline to break the downtrend and validate bullish momentum toward the coveted $3.00.

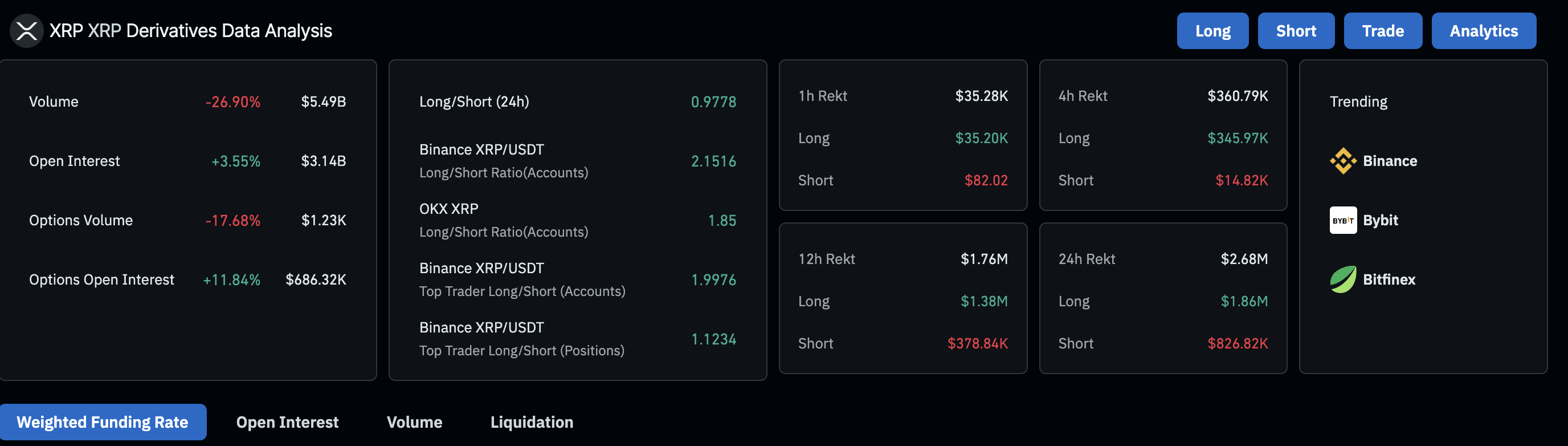

Meanwhile, a 3.55% increase in the derivatives' open interest to $3.14 billion, per CoinGlass data, hints at improving sentiment around XRP. In other words, traders are willing to bet on higher price levels in the short term.

Derivatives data | Source: Coinglass

CryptoQuant data reveals a significant drop in XRP's exchange inflow volume. Based on the chart below, the token's exchange inflows have plunged by 96% from over 2 billion on April 4 to approximately 77 million XRP on Thursday. Declining inflows into exchanges significantly reduce potential sell-side pressure. They show that investors are willing to hold onto their tokens, anticipating higher prices.

-1744953176169.png)

Exchange inflow data | Source: CryptoQuant

However, traders must remain vigilant with the Relative Strength Index (RSI) in the daily chart that is stuck below the center line and gradually dropping toward the oversold region. The XRP price is still in the woods and could post significant declines below the $2.00 support and the 200-day EMA, and possibly retest April 7 support at $1.60.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.