Token unlocks over $625 million this week across major projects SUI, OP, SOL, AVAX and DOGE

Wu Blockchain says 11 altcoins with one-time tokens unlock more than $5 million each in the next seven days.

The total value of cliff and linear unlocked tokens exceeds $625 million.

Traders should be cautious as token unlocks frequently generate negative sentiment among investors, weighing down prices.

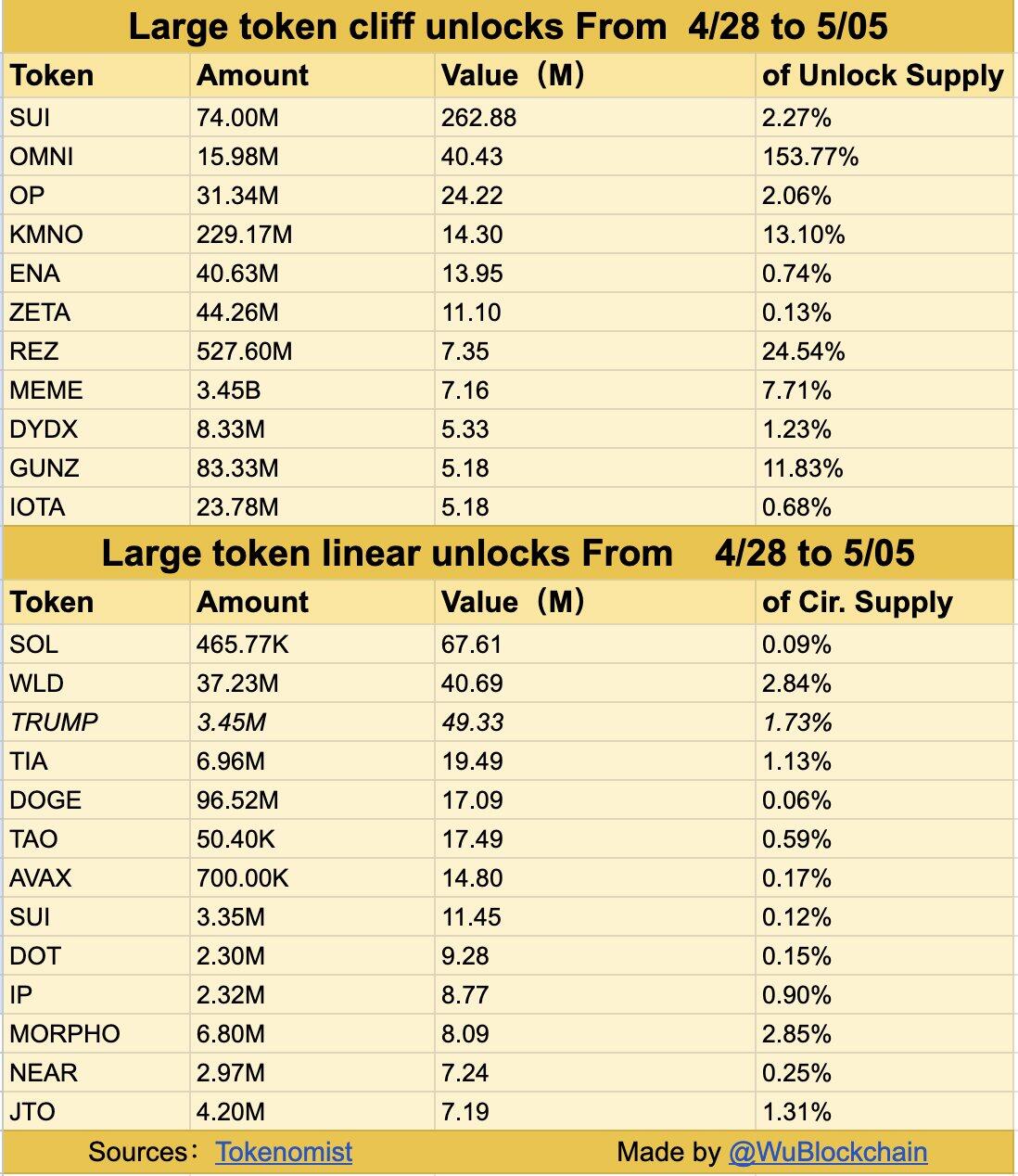

According to Wu Blockchain, 11 altcoins with one-time tokens unlock more than $5 million each in the next seven days. The total value of cliff and linear unlocked tokens exceeds $625 million. Traders should be cautious as token unlocks frequently generate negative sentiment among investors, weighing down prices.

Token unlocks could bring volatility in SUI, OMNI, OP and others

Wu Blockchain reports that 11 altcoins with one-time token unlocks (cliff unlocks) are worth more than $5 million each over the next seven days. The cliff unlock allows a certain number of tokens to be unlocked immediately after a certain period.

The list includes Sui (SUI), Omni Network (OMNI), Optimism (OP), Kamino (KMNO), Ethena (ENA), ZetaChain (ZETA), Renzo (REZ), Memecoin (MEME), dYdX (DYDX), Gunz(GUN), and IOTA (IOTA). OMNI, KMNO, REZ, and GUNZ are unlocking tokens more than 10% of their circulating supply. Typically, when a token unlocks accounts for over 1% of the cryptocurrency’s circulating supply, it will likely have a negative impact on the price. Therefore, traders should monitor these four assets for increased volatility this week.

Moreover, the large token linear (daily unlock amounts over $1 million) unlocks this week include Solana (SOL), Worldcoin (WLD), Official Trump (TRUMP), Celestia (TIA), Dogecoin (DOGE), Bittensor (TAO), Avalanche (AVAX), Sui (SUI), Polkadot (DOT), Story (IP), Morpho (MORPHO), NEAR Protocol (NEAR), and Jito (JTO).

While an increase in a cryptocurrency’s circulating supply is typically bearish, planned unlock schedules may have a less significant impact, as the community of traders anticipates the unlock and likely positions themselves accordingly.

However, traders should remain cautious as the increased supply from token unlocks frequently generates negative sentiment among investors, which can weigh down prices.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.