Crypto today: BTC price taps $83K as SOL, ETH and DOGE gain billions after Trump’s tariff U-turn

Cryptocurrency market capitalization rebounded above $2.7 trillion on Wednesday as markets reacted to multiple volatility triggers

Trump dropped tariffs imposed on all US trade partners to a flat rate of 10%, except China, sparking a sharp recovery across global markets.

Bitcoin price rebounded above $82,600, posting 6.5% gains after plunging as low as $74,600 earlier on Wednesday.

Following Trump’s U-turn, Solana, XRP and Dogecoin have pulled the biggest gains among the top 10 ranked altcoins.

Why is the crypto market going up?

The cryptocurrency market witnessed another 6.5% upswing on Wednesday, with an aggregate market capitalization of $2.7 trillion at press time, according to Coingecko. The current uptick comes after US President Donald Trump dropped his country-specific tariffs down to a flat rate of 10% for all trade partners, except China, on which he opted to impose an increased 125% tariff.

Bitcoin market updates:

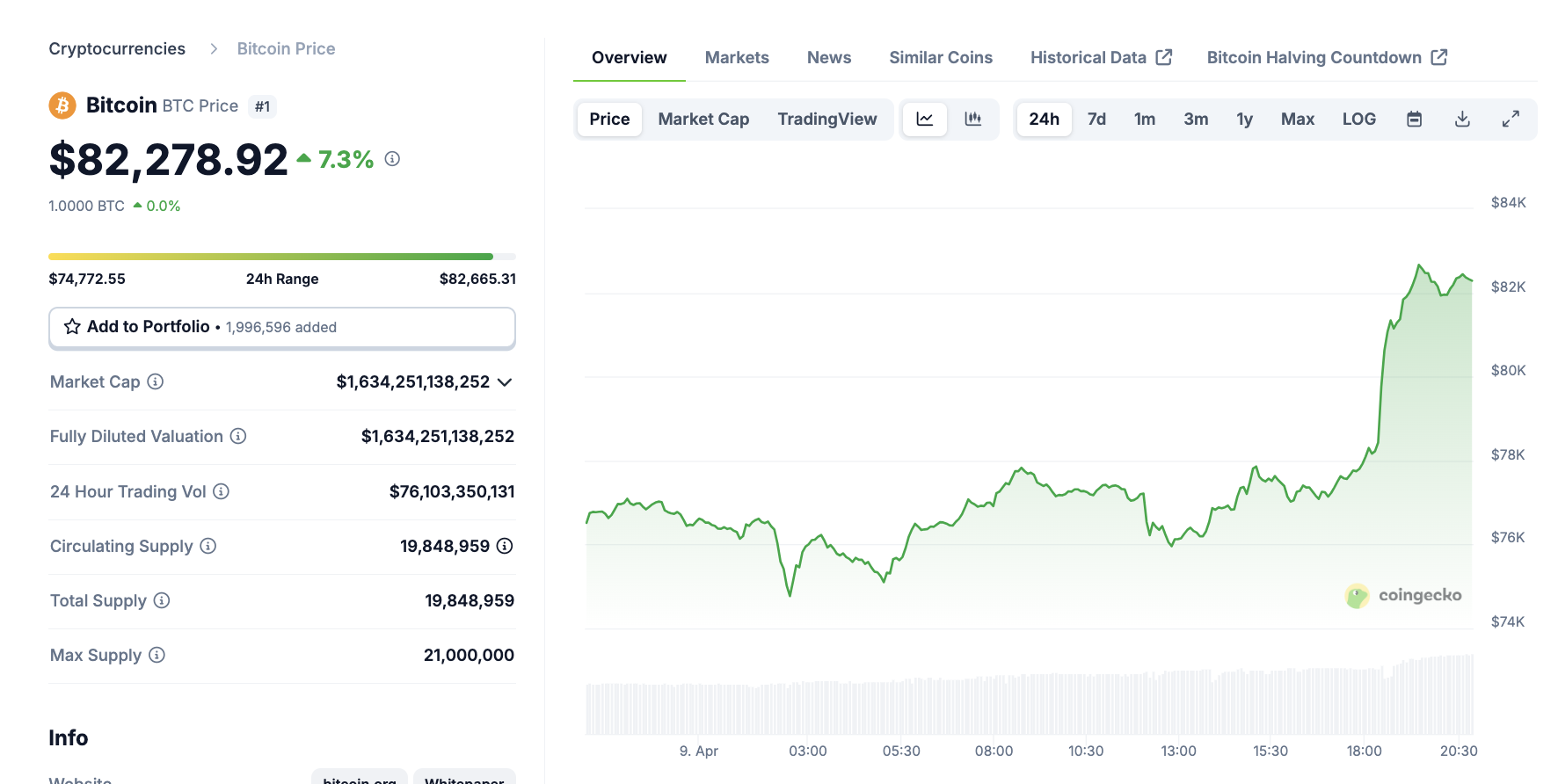

Bitcoin is currently trading at $82,500, experiencing another day of intense volatility.

Coingecko data shows that BTC has already bounced with a massive 11% range between $74,700 to $82,500.

Bitcoin price performance, April 9, 2025 | Coingecko

Bitcoin’s swinging within a double-digit percentage range within 18 hours signals indecision among investors. It could also indicate that swing traders are capitalizing on volatile sentiment and mixed signals from the global reactions to Trump’s tariff to execute short-term plays.

Altcoin market updates: One week after Trump tariffs, ETH, XLM and SUI emerge top losers

Altcoins are outperforming Bitcoin as Trump’s drastic u-turn on trade tariffs cutting triggered instant buying pressure across the global markets.

Market data from Coingecko shows that Solana, Cardano and Ripple (XRP) have risen the quickest among the top 25 ranked assets.

Chart of the Day: ETH, XLM and SUI lead losers after another 62% dip

Crypto Market Performance, April 9 | Source: Coingecko

At press time on Wednesday, the global crypto market surged by 6.5% to hit $2.7 trillion.

As crypto market valuation surges by $84.5 billion, a closer look at the data shows Solana leading the way with 11.7% price gains in the 24-hour time frame.

Ethereum followed in close second, as traders capitalizing on its oversold status drove 10.5% gains at press time.

Meanwhile, Dogecoin narrowly pips Cardano’s price performance, with both assets posting 10.3% and 10.5% gains, respectively, at the time of writing.

With Asian markets still closed, these altcoins could see more capital inflows as the global reactions to Trump’s trade tariff reversal could prompt investors to redirect funds toward risk asset markets.

Crypto news updates:

21Shares and House of Doge launch Dogecoin ETP on SIX Swiss Exchange under ticker DOGE

21Shares, a leading issuer of crypto exchange-traded products, has partnered with House of Doge to list a new Dogecoin ETP on the SIX Swiss Exchange. The product, trading under the ticker DOGE, is the first Dogecoin ETP to be officially endorsed by the Dogecoin Foundation.

The ETP is fully physically backed, offering investors secure, institutional-grade exposure to the cryptocurrency without the need to directly manage digital wallets or private keys.

Argentina Congress launches probe into officials tied to Libra memecoin scandal

Argentina’s Chamber of Deputies has approved a motion to open an official investigation into government officials allegedly connected to the Libra memecoin scandal.

The resolution includes the formation of a special commission, the summoning of key administration figures, and a formal request for documentation on the government’s relationship with Libra, a Solana-based token developed by Kelsier Ventures, a Delaware-based firm.

The probe follows intense public backlash after President Javier Milei’s early endorsements of Libra led to a sharp price rally, followed by a rapid collapse. The fallout prompted allegations of fraud and sparked impeachment discussions.

Lawmakers are focusing on whether senior officials had prior knowledge of the token’s risks and if any conflict of interest or misuse of influence occurred during its promotion.

Tether raises Bitdeer stake to 22.8%, SEC filing shows

Tether has increased its equity stake in Bitcoin mining firm Bitdeer Technologies Group from 21% to 22.8%, according to a new filing with the US Securities and Exchange Commission (SEC).

The update was disclosed in a Schedule 13D/A amendment submitted on Tuesday, reflecting Tether’s continued expansion into the crypto infrastructure sector.

The increased shareholding strengthens Tether’s position as a significant investor in Bitdeer, a Nasdaq-listed company focused on crypto mining operations globally. The move comes amid broader strategic efforts by Tether to diversify beyond stablecoins and into energy and crypto mining.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.