Ethereum Price Forecast: Trump's tariff pause lifts ETH as SEC approves options trading on ETH ETF

Ethereum price today: $1,670

Ethereum saw a 13% gain on Wednesday after President Trump announced a 90-day tariff pause on 75 countries.

The SEC approved Fidelity, BlackRock, Bitwise and Grayscale applications for options trading on their spot Ether ETFs.

Two leveraged ETFs shorting ETH are the best-performing ETFs so far in 2025.

Ethereum bulls are targeting a move to the $1,800 key level after recovering the $1,500 support.

Ethereum (ETH) gained 13% on Wednesday after President Trump announced a 90-day tariff pause on 75 countries. Following the announcement, the Securities and Exchange Commission (SEC) approved Fidelity, BlackRock, Bitwise and Grayscale applications to allow options trading on their spot Ether ETFs.

SEC approves options trading on ETH ETF; -2x ETH ETF best-performing product

Ethereum has seen increased buying pressure in the past few hours since President Donald Trump announced a 90-day tariff pause on 75 countries. The top altcoin jumped from a two-year low of $1,400 to above $1,650 at press time.

The announcement follows the SEC approving NYSE, Nasdaq and Cboe applications to list and trade options contracts on Bitwise and Grayscale, BlackRock and Fidelity spot Ether ETFs, respectively.

Option trading could make an ETF product attractive as it introduces regulated risk management and hedging strategies that are important to institutional investors — especially during periods of market uncertainty like the current trading environment.

“SEC has approved options trading on spot eth ETFs…Like w/ btc ETFs, expect to see a bunch of new launches from issuers — Covered call strategy eth ETFs, buffer eth ETFs, etc,” wrote Nate Geraci, President of The ETF Store in an X post on Wednesday.

The approval comes at a time when ETH ETF holders are seeing increased losses — down over 50% YTD — following the global risk-off sentiment across financial markets. This has largely affected flows in Ethereum ETFs, which have only recorded four days of inflows since February 20, per Farside Investors data.

While ETH ETF holders lament, products betting against it have been among the top gainers across the global ETF market since January.

Two -2x ETH ETFs — which represent a 2x leverage short positioning on ETH ETFs — are the best-performing ETFs so far in 2025, according to Bloomberg analyst Eric Balchunas. The products have seen gains above ETFs tracking volatility despite increased market uncertainty in the past months.

Ethereum Price Forecast: ETH bulls recover $1,500, targets $1,800 next

Ethereum saw $169.04 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions accounted for $63.28 million and $105.76 million respectively.

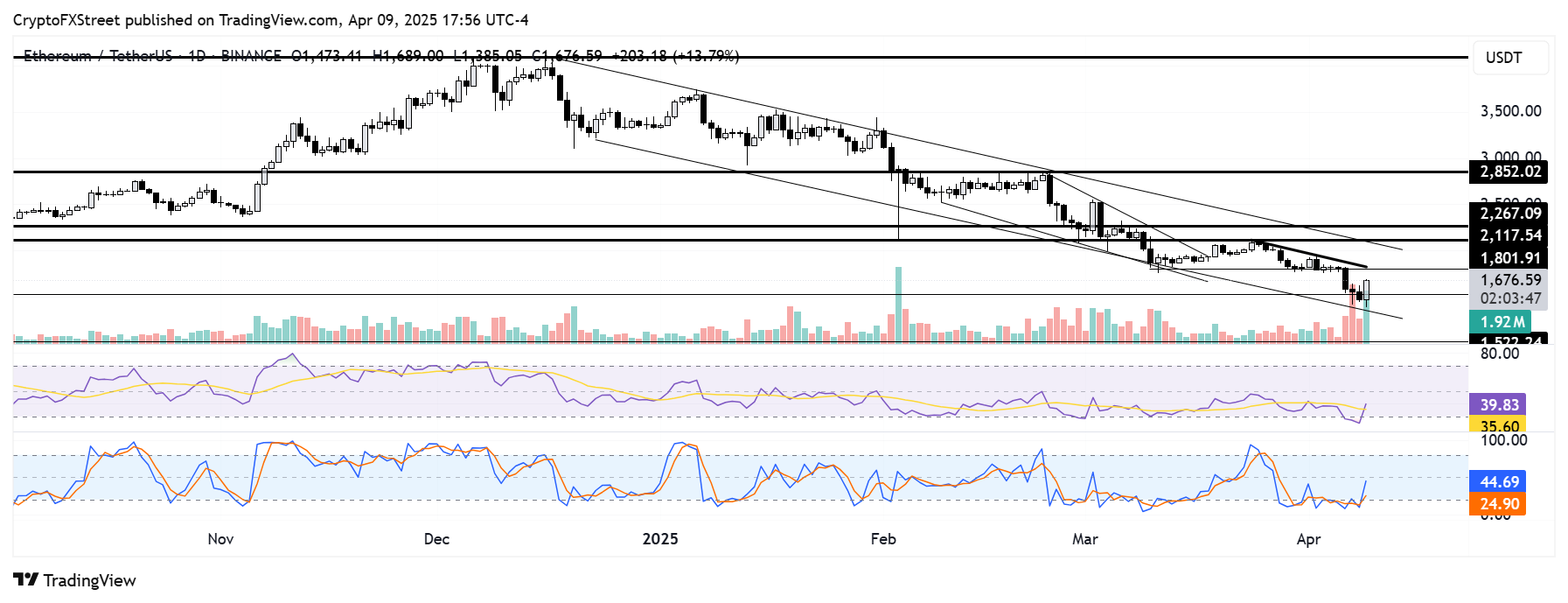

ETH recovered the support level near $1,500 after bouncing near a descending channel's lower boundary and surging over 13%. If the rally isn't short-lived, ETH could also reclaim $1,800 and go on to test the descending channel's upper boundary resistance. On the downside, the $1,500 support is a key level to watch if ETH retraces.

ETH/USDT daily chart

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are trending upward but below their neutral levels. A firm cross into the upper region will strengthen the bullish momentum.

A daily candlestick close below $1,500 will invalidate the thesis.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.