Ethereum Price Forecast: ETH risks a decline to $1,000 amid selling pressure from DeFi liquidations

Ethereum price today:

Ethereum short-term holders have spearheaded the recent selling activity, realizing over $500 million in losses on Monday.

Rising DeFi liquidations could accelerate ETH's decline and potentially set off more liquidations.

ETH could decline to $1,000 if it breaches the lower boundary of a descending channel.

Ethereum (ETH) suffered a more than 27% crash within the past 48 hours, briefly dropping to a two-year low of $1,410 before recovering the $1,500 level on Monday. The decline, per Coinglass data, sparked $257.87 million in liquidations across ETH's derivatives market during the period.

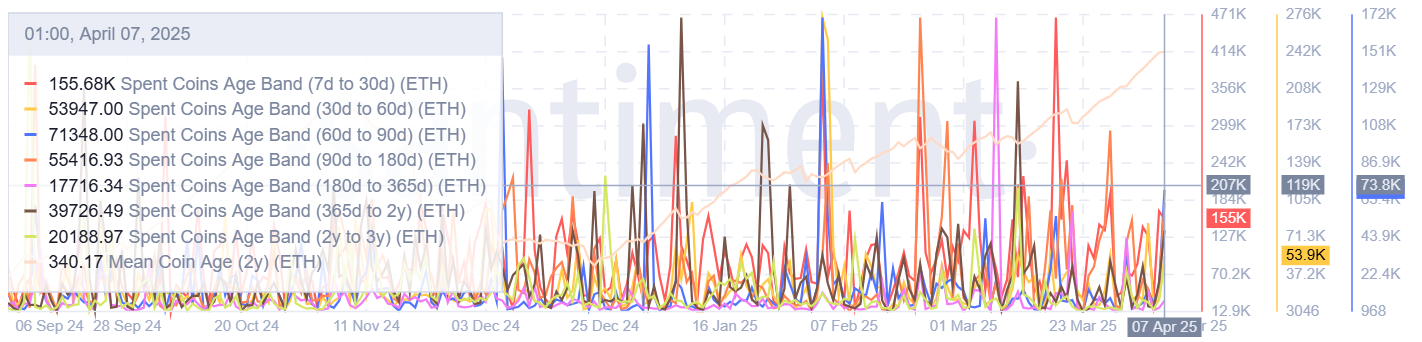

On-chain data also shows most investors are capitulating, sending ETH realized losses past $500 million, according to Santiment. Most recent selling activity stems from coins purchased in the past month, highlighting short-term holders' strong reaction to downside price moves.

Furthermore, coins aged 1Y to 2Y are joining the selling but at a modest pace. An increase in selling pressure from this cohort could spark an extended decline in ETH as most buy-the-dip activity has largely flowed into addresses related to them.

ETH spent coins age band. Source: Santiment

ETH risks further downside pressure if DeFi liquidations continue

Increased liquidations across DeFi protocols have partly accelerated ETH's decline.

Sky, formerly Maker, liquidated a whale's collateral of 53,074 ETH worth $74 million at the time, per Lookonchain data.

Sky allows users to create and borrow DAI stablecoin using ETH as collateral. The protocol automatically liquidates borrowers' positions when the value of their collateral drops below a certain threshold.

Another whale with a collateral of 220K ETH added 10K ETH and 3.52M DAI to reduce its liquidation price to $1,119. The whale risks losing all its collateral if ETH plunges below $1,119.

Similar liquidations are visible in lending platform Aave, where the protocol recorded over $162 million in liquidated collateral on Monday, according to @KARTOD Dune dashboard.

Ethereum Price Forecast: ETH eyes $1,000 amid heightened bearish pressure

Ethereum is grappling with the support level near $1,522 after seeing a quick bounce off the lower boundary of a descending channel that extends back to December. The top altcoin could suffer a further decline to the support near $1,000 if it breaches the channel's lower boundary.

ETH/USDT daily chart

On the upside, ETH could see a rejection near the $1,800 resistance, which is strengthened by a key descending trendline.

The Moving Average Convergence Divergence (MACD) histogram bars are below their neutral level, while the Relative Strength Index (RSI) is in the oversold region. This indicates dominant bearish momentum but with a potential for a reversal.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.