Bitcoin's surge to $94,000 shows a mix of macro optimism and shifting investor sentiment: Glassnode

Bitcoin rallied above $94,000 due to positive developments surrounding the US-China trade war.

BTC's surge caused the percentage of its supply in profit at current price levels to rise to 87.3% from 82.7% in March.

Bitcoin ETFs recorded $1.83 billion in net inflows between Tuesday and Wednesday, signaling an increase in institutional demand for Bitcoin exposure.

Bitcoin (BTC) traded above $93,000 on Thursday as rumors of US-China tariff easing stirred a rebound in price, sending the percentage of supply in profit at current price levels to 87.3%, 5% above 82.7% recorded in March, according to Glassnode data. The Short-term Holders (STH) Profit/Loss Ratio also rose to neutral levels at 1.0, indicating that the market has slightly moved from bearish territory to safer grounds.

Bitcoin’s cross above $90K sees short-term holders demonstrating high profit-taking behavior

This week, the crypto market rebounded from recent downturns, with Bitcoin climbing as high as $94,000 on Tuesday. Bitcoin's rally stemmed from speculations of a calm in the US-China tariff war, which quickly sparked optimism among investors.

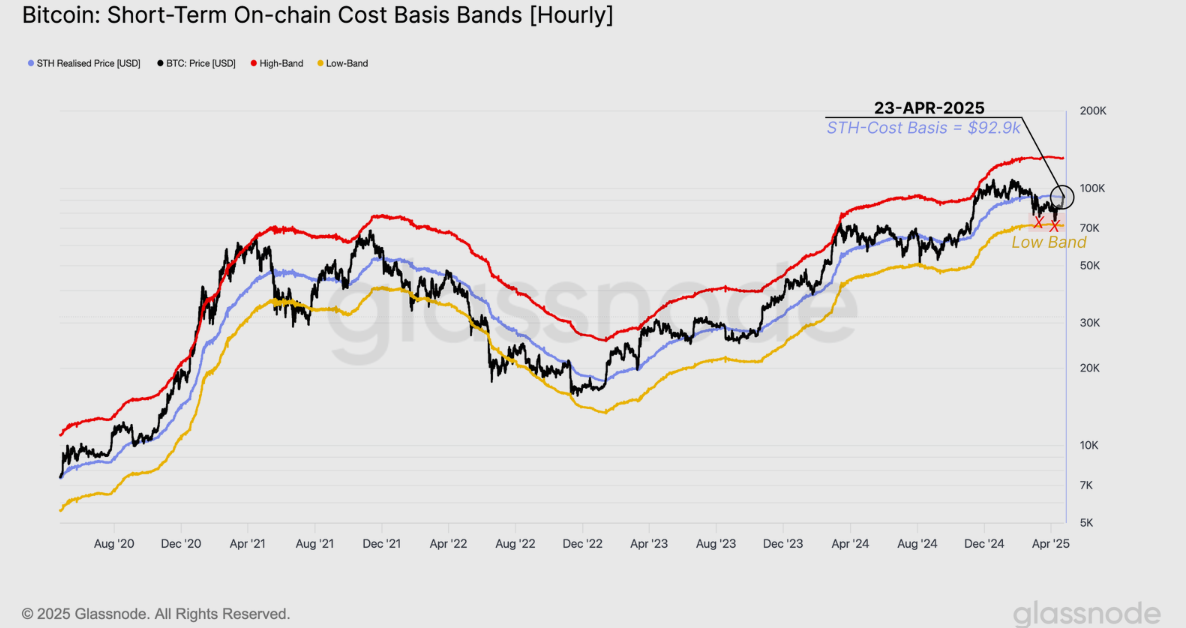

The rally caused Bitcoin to break above the Short-term Holder (STH) Cost Basis — a metric measuring the average purchase price of short-term holders — currently at $92,900, according to Glassnode's weekly on-chain report. The report stated that a move above the STH Cost Basis historically signals the end of a bearish phase and the start of a new bullish trend.

BTC STH Cost Basis. Source: Glassnode

The rise was also accompanied by a recovery in unrealized profit held by investors. Bitcoin's percentage supply in profit metric rose to 87.3%, 5% more than the previous range of 82.7% — when Bitcoin last traded around $94,000 in early March. This indicates that 5% of Bitcoin's circulating supply has changed hands at lower price levels since early March.

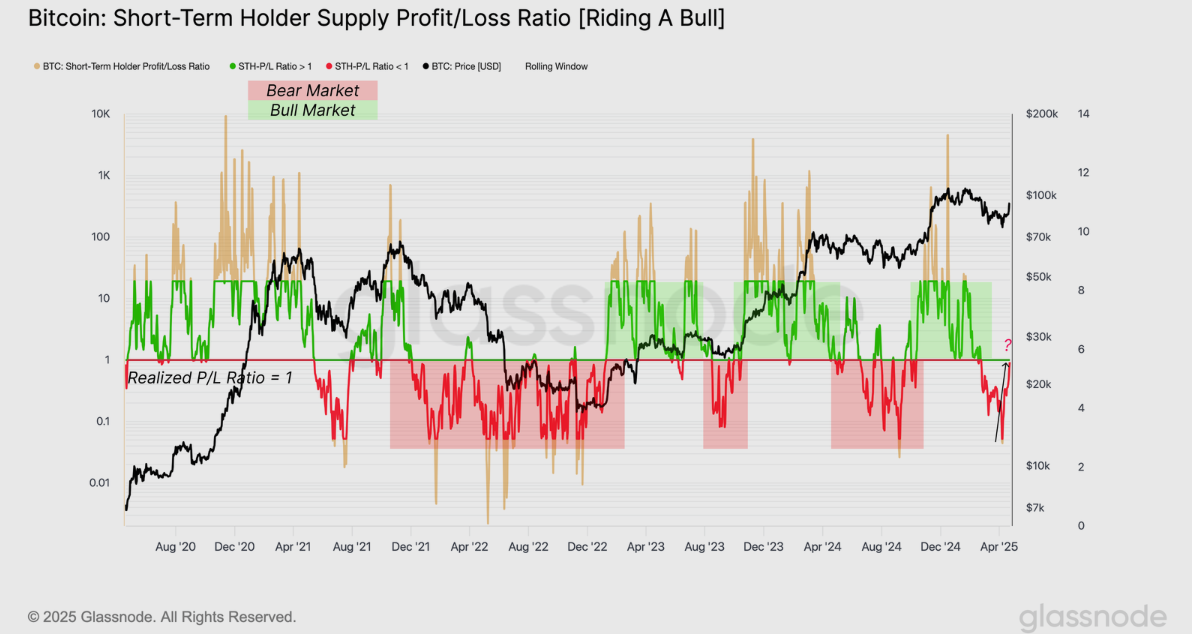

Alongside the unrealized profit metric, Glassnode's analysts revealed a rise in the STH Supply Profit/Loss Ratio to a neutral level of 1.0.

"This suggests that short-term supply is more evenly split between coins in profit and loss, making this a point of balanced sentiment for this cohort," Glassnode stated in the report.

A movement to neutral levels is significant, as it signals that Bitcoin has risen out of a bearish phase to more stable ground. A push or pullback from here will either lead to a local top for BTC or a more robust recovery.

Bitcoin STH Supply Profit/Loss Ratio. Source: Glassnode

However, the recent surge in prices has been accompanied by high profit-taking behavior among short-term investors, showing that many are taking advantage of the rally to realize profits.

Glassnode stated that if the market can withstand this wave of selling without a major pullback, it would signal a healthier and more resilient outlook for BTC.

On the other hand, if current levels fail to hold under the weight of this profit-taking, the recent price rise could prove to be yet another "dead cat bounce." This indicates that the recovery could be short-lived, mirroring previous relief rallies, which ultimately lost momentum under similar conditions.

Additionally, Bitcoin has received strong support among institutional investors during this period, with ETFs netting inflows of $1.83 billion between Tuesday and Wednesday, according to Farside Investors data. This implies that bullish sentiment is gradually rising among traditional investors.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.