Elon Musk tags Milton Friedman as three Forbes Billionaires ask Trump to end Trade War

Elon Musk tags Milton Friedman as three Forbes Billionaires ask Trump to end Trade War

Elon Musk tags Milton Friedman as Wall Street billionaires appeal to Trump for tariff cut.

JP Morgan CEO Jamie Damno warns that the tariffs could trigger a US recession in 2025.

Billionaire fund manager, Bill Ackman, also reiterated appeals for a pause on the tariffs.

Tesla CEO, and Department of Government Efficiency lead, Elon Musk takes a stand against Trump’s tariffs positive a viral Milton Friedman video on X. Meanwhile other top Wall street billionaires have also launched media campaigns to avert the looming US trade war.

Elon Musk tags Milton Friedman as markets sink on tariff fears

Elon Musk has joined a growing list of U.S. billionaires urging President Donald Trump to reconsider his sweeping new tariffs. On Monday Musk shared a 1970s video clip of renowned economist Milton Friedman denouncing protectionism. The post intensifies mounting pressure from America’s billionaires as markets continue to slump on trade war fears.

Notably, Musk’s close associate and investor Joe Lonsdale also weighed in on X, revealing that he had recently warned “friends in the administration” that the tariffs would likely hurt American companies more than Chinese ones.

“I argued to friends in the administration in recent days that tariffs would hurt American companies more than Chinese ones,” Lonsdale posted on X (formerly Twitter) Tuesday.

His comments come days after a Washington Post report revealed top Trump aides attempted to quietly intervene over the weekend to de-escalate tensions. Despite this, the former president doubled down in a Sunday night interview, declaring there would be “no chance” of backing down—though fresh rumors of a negotiation window emerged after Musk’s post went viral.

Jamie Dimon warns Trump tariffs could trigger US recession

JPMorgan Chase CEO Jamie Dimon issued a pointed warning on Monday, cautioning that former President Trump’s aggressive tariff push could fuel inflation and drag down an already fragile U.S. economy.

In his April 7 annual shareholder letter, Dimon became the first major Wall Street bank CEO to speak out directly against the April 2 tariff announcement—a move that triggered the steepest stock market losses since the COVID-19 crash of 2020.

“We are likely to see inflationary outcomes, not only on imported goods but on domestic prices, as input costs rise… Whether or not the menu of tariffs causes a recession remains in question, but it will slow down growth,” Dimon wrote.

At press time, Dimon is worth $2.3 billion, according to Forbes. Though he frequently weighs in on global economic risks, this year's warning comes amid real-time volatility. The timing of his letter added credibility to mounting concerns from the financial elite.

Bill Ackman warns tariffs could cause “economic nuclear winter”

In a lengthy post on X Sunday, billionaire hedge fund manager Bill Ackman, worth $8.8 billion, issued a grim forecast for the U.S. economy, warning that President Trump’s sweeping tariffs could destroy investor confidence and ignite an “economic nuclear winter.”

Ackman, founder of Pershing Square and a high-profile Trump supporter since mid-2024, acknowledged that the global tariff system has long disadvantaged the U.S. But he blasted Trump’s current approach as “massive and disproportionate,” targeting allies and adversaries alike.

“We are in the process of destroying confidence in our country as a trading partner, as a place to do business, and as a market to invest capital,” Ackman warned.

His rare public rebuke marks a shift for the influential investor, echoing Jamie Dimon’s concerns while adding urgency. Ackman called on the White House to implement a 90-day pause to renegotiate terms, warning that without it, business investment would freeze, consumers would stop spending, and the U.S. would suffer reputational damage that “may take decades to repair.”

Conclusion: Wall Street billionaires passing a “vote of no confidence”

From Musk’s nod to Friedman’s free-market legacy to Ackman’s doomsday forecast and Dimon’s recession alarm, Blackrock CEO Larry Fink has also warned that markets could drop by another 30%.

At press time on Wednesday, the tariff tailwinds have seen over $10 trillion wiped off the US stocks markets within the first week.

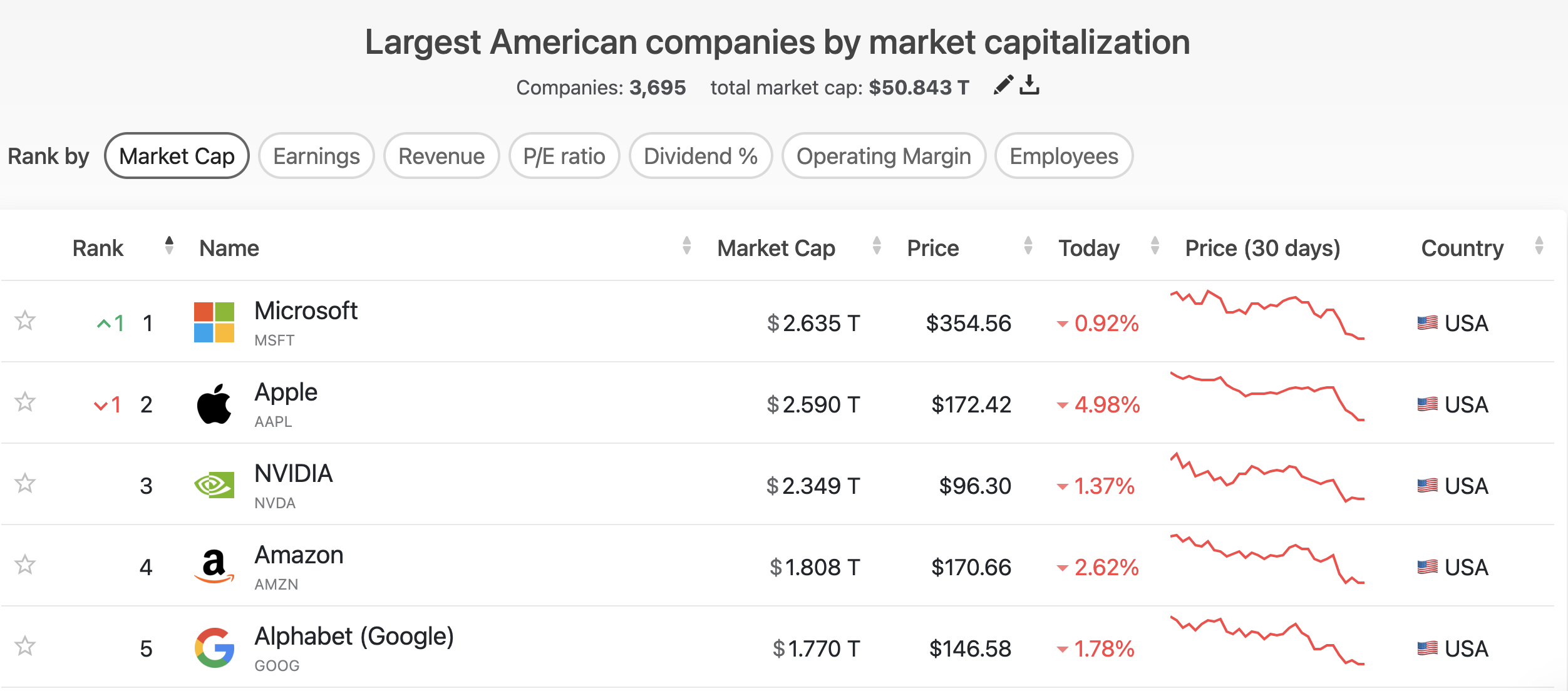

Top 5 US Stock Market Performance, April 9 | Source: CompaniesMarketCap

Trump has confirmed that 104% tariffs will take effect on all Chinese imports from April 9. Meanwhile, business leaders on Wall Street are warning that —while framed as a strategy to correct systemic trade imbalances, the aggressive tariffs risks could trigger the very economic instability the administration aims to avert.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.